The European Central Bank’s programme of ‘quantitative easing’ has seen over €46 billion of public funds invested in sectors including the oil, gas and car industries.

A short report published by Corporate Europe Observatory this week highlights the dubious nature of many corporate bonds bought since the bank’s economic growth scheme was launched in June 2016.

As soon as it started, we as QE for People campaign have been actively criticizing this section of the ECB’s QE programme. We warned against this unnecessary move that could potentially jeopardize further more the ECB’s reputation, especially at times when euroscepticism is on the rise. In that sense, the case of Bayer is particularly revealing.

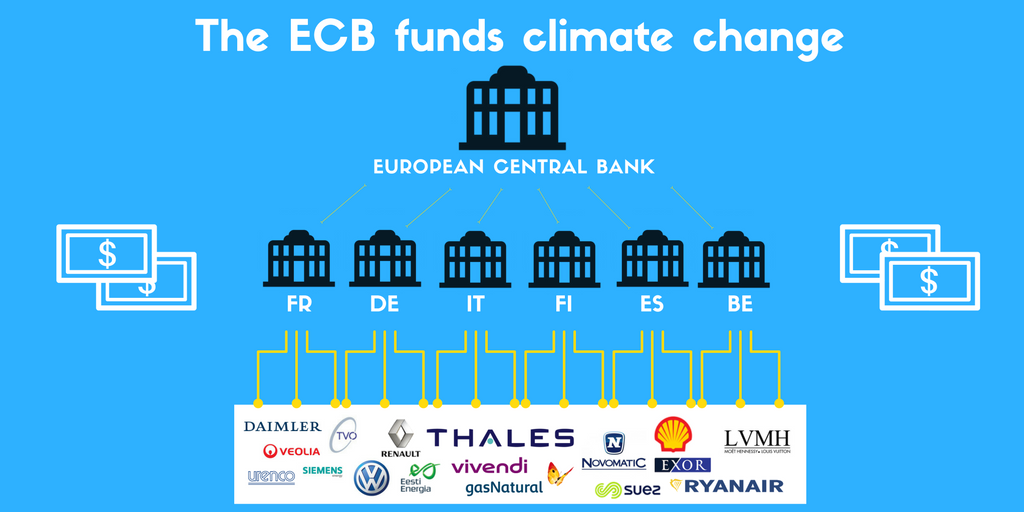

The report “ECB funds multinationals and climate” confirms our concerns. It provides the first ever analysis of these bond purchases that looks at the full list of companies benefiting from the scheme coordinated by the European Central Bank (ECB) and executed by the central banks of France, Germany, Finland, Spain, Italy and Belgium. The ECB makes it difficult to trace its links to companies, not publishing any information other than the so-called International Securities Identification Number (ISIN) of purchased bonds.

Decoding the ISINs, Corporate Europe Observatory was nevertheless able to reveal the types of companies propped up by ECB bond purchases. The distinct investment pattern that emerged points to a complete lack of consideration for the sensible use of public funds.

A big share of bonds acquired for the ECB by national central banks belong to actors in the oil, gas and car industries. Investments in the arms industry, a gambling corporation and companies driving the privatisation of water also raise eyebrows.

In the context of individual EU member states, the following ECB bond acquisitions are particularly questionable:

Banque de France purchases from water companies Veolia, Suez and Vivendi, as well as oil and gas companies Total and Air Liquide, car maker Renault, arms manufacturer Thales and luxury goods producer LVHM

Banque Nationale de Belgique purchases from oil and gas companies Shell, Apetra, SPP, Nederlandse Gasunie and aerospace manufacturer Airbus

Banco de España purchases from oil and gas companies Repsol, Gas Natural and Enagas

Bundeszentralbank purchases from car makers Volkswagen, BMW and Daimler AG

Banca d’Italia purchases from oil and gas companies Eni and Snam

Finlands Bank purchases from gambling corporation Novomatic, oil and gas companies OMV AG and Eesti Energia, as well as budget airline Ryanair

“This investment pattern cannot be justified”

Corporate Europe Observatory’s financial policy researcher Kenneth Haar said:

“The ECB is reluctant to provide information about the value of its bond purchases and even makes it difficult to find out which companies it buys into. As they use public funds to buy these bonds, the secrecy is dubious.”

“When you look at the list of companies from which the ECB has bought bonds, you can certainly see a plausible motive for not revealing too much. Apparently the bank is quite content to support car producers, a gambling corporation, arms producers, and especially fossil fuel corporations that are driving climate change. Whichever way you look at it, this investment pattern cannot be justified.”

“It would have made so much sense to use these billions of euros to create employment in environmentally sustainable sectors instead, but the status quo in European politics is still to put corporate profits before public interest.”

Green MEPs call on the ECB to change course

Following up on the report, Green Members of the European Parliament (Ernest Urtasun, Sven Giegold, Molly Scott-Cato and Reinhard Bütikofer) have sent a joint open letter to Mario Draghi calling upon the ECB to to integrate Environmental, Social and Governance (ESG) criteria into the purchase programmes and consequently exclude and divest from carbon-intensive assets.”

The letter reads: “now that EU has ratified the Paris Agreement, we have a tremendous challenge to orderly decarbonise our economy. At least 75% of fossil fuel reserves have to be kept in the ground to reach the 2° global warming limit agreed in Paris. We would like to formally request you to ensure the full alignment with EU environmental global commitments of the ECB’s current or, eventually future, private sector purchase programmes.”

Stanislas Jourdan from the Quantitative Easing for People initiative concludes:

“The programme is economically unnecessary and ethically questionable. It does not benefit SMEs or the real economy, but instead subsidises large corporations which clearly do not need cheaper funding when rates are already so low.

“Ultimately it also damages the Bank’s reputation and risks fuelling more populism against the EU. The Bank should therefore immediately stop its corporate bonds purchases.”

Note: This article was originally published on the QE for People campaign website. As we are gradually phasing out the QE for People campaign, we are archiving this publication here. For more information, read the history of Positive Money Europe.

Thank you for this very valueable information. I will include it into my bachelor thesis about the ECB and its overcoming of climate change.