In an open letter to the European Central Bank’s president Mario Draghi, Green MEPs urge the ECB to align its quantitative easing programme with the EU environmental global commitments.

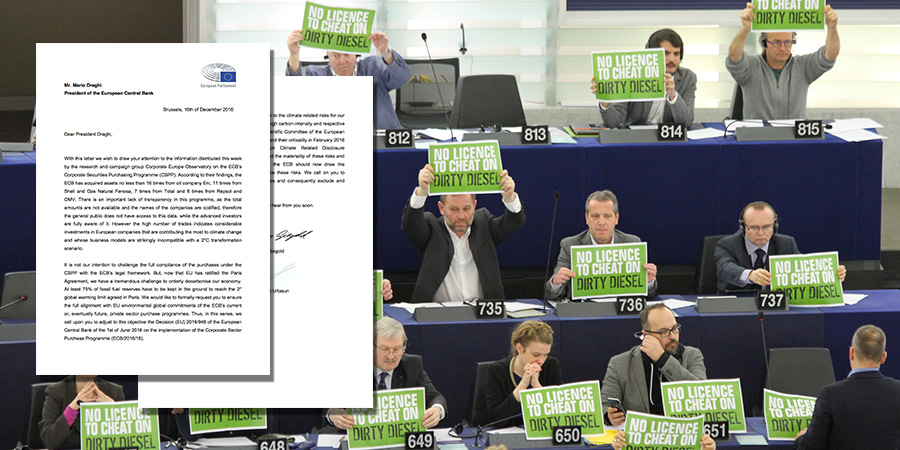

Last Friday, a group of 4 members of the European Parliament sent a public letter to Mario Draghi, asking the ECB to adjust its quantitative easing guidelines in order to include social an environmental criteria when it comes to buying private companies bonds.

The letter reads: “now that EU has ratified the Paris Agreement, we have a tremendous challenge to orderly decarbonise our economy. At least 75% of fossil fuel reserves have to be kept in the ground to reach the 2° global warming limit agreed in Paris. We would like to formally request you to ensure the full alignment with EU environmental global commitments of the ECB’s current or, eventually future, private sector purchase programmes.”

The letters follows up on Corporate Europe Observatory’s report published last week which denounced the ECB’s corporate bonds purchases for fueling climate change. The report unveiled the extend to which the ECB has actively purchases bonds from climate change multinationals, thereby providing an explicit subsidy to those company. CEO’s report was widely covered by international media including the Guardian.

Catalan MEP Ernest Urtasun commented: “The presence of polluting companies within the ECB’s corporate securities purchase program by the ECB is unacceptable. 53% of emissions in Spain purchased in this program correspond to companies of fossil fuels. The conditions of this program funded allow very favorable and are an indirect subsidy to its activities.”

“Imagine if this €46 billion euro had been spent on, say, insulating homes. A rough estimate shows that this eminently practical effort against climate change could have paid for the insulation of 66 million houses and led to tens of thousands of jobs.” Corporate Europe Observatory concludes in its report.

The QE for People campaign has actively denounced the ‘corporate QE’ of the ECB since it was announced, predicting a wave of controversy around it. Although the ECB’s purchases are not technically illegal, they are ethically wrong.

“Either the ECB is able to make its practices aligned with the environmental objectives of the EU at least by applying social and environmental criteria, or the corporate bonds purchases should be stopped entirely.” campaign coordinator Stanislas Jourdan said.

We therefore welcome the Green MEPs’ letter which provides further pressure on the ECB to stop with this highly controversial and unnecessary practice.

Find below the full content of the letter address to Mario Draghi (pdf available here):

Dear President Draghi,

With this letter we wish to draw your attention to the information distributed this week by the research and campaign group Corporate Europe Observatory on the ECB’s Corporate Securities Purchasing Programme (CSPP). According to their findings, the ECB has acquired assets no less than 16 times from oil company Eni, 11 times from Shell and Gas Natural Fenosa, 7 times from Total and 6 times from Repsol and OMV. There is an important lack of transparency in this programme, as the total amounts are not available and the names of the companies are codified, therefore the general public does not have access to this data, while the advanced investors are fully aware of it. However the high number of trades indicates considerable investments in European companies that are contributing the most to climate change and whose business models are strikingly incompatible with a 2°C transformation scenario.

It is not our intention to challenge the full compliance of the purchases under the CSPP with the ECB’s legal framework. But, now that EU has ratified the Paris Agreement, we have a tremendous challenge to orderly decarbonise our economy. At least 75% of fossil fuel reserves have to be kept in the ground to reach the 2° global warming limit agreed in Paris. We would like to formally request you to ensure the full alignment with EU environmental global commitments of the ECB’s current or, eventually future, private sector purchase programmes. Thus, in this sense, we call upon you to adjust to this objective the Decision (EU) 2016/948 of the European Central Bank of the 1st of June 2016 on the implementation of the Corporate Sector Purchase Programme (ECB/2016/16).

Furthermore, we would like to draw your attention to the climate related risks for our financial system deriving from companies with a high carbon-intensity and respective assets. Under your leadership, the Advisory Scientific Committee of the European Systemic Risk Board has underlined these risks and their criticality in February 2016 and the very recent FSB Task Force on Climate Related Disclosure Recommendations Report has de facto underlined the materiality of these risks and presented ways of reporting them. Therefore, the ECB should now draw the consequences from its own analyses and reduce these risks. We call on you to integrate ESG criteria into purchase programmes and consequently exclude and divest from carbon-intensive assets.

We thank you for your good attention and hope to hear from you soon.

Yours sincerely,

Ernest Urtasun

Sven Giegold

Molly Scott-Cato

Reinhard Bütikofer

Note: This article was originally published on the QE for People campaign website. As we are gradually phasing out the QE for People campaign, we are archiving this publication here. For more information, read the history of Positive Money Europe.