By established practice, the European Central Bank is only accountable to the European Parliament. Yet since the crisis, the ECB President has accepted to visit six national parliaments where he was questioned by elected representatives. While those hearings have been subject to important media attention, Tobias Tesche argues they are undermining the ECB’s accountability towards the European Parliament.

In August 2018 an article appeared in the ECB’s Economic Bulletin under the heading ‘The evolution of the ECB’s accountability practices during the crisis’. In it, the authors assessed how the euro area crisis has changed the ECB’s accountability framework. Somewhat unsurprisingly, they claim that the accountability structure proved flexible enough to cope with the various crisis pressures. Hence, no changes are needed. The article only briefly acknowledges that ECB President Draghi has visited six national parliaments (the German, French, Spanish, Finnish, Italian and Dutch) but that interactions with national parliaments are not part of the ECB’s accountability activities. Why don’t these visits feature more prominently as a radical departure from past accountability practices in the ECB’s narrative?

In an article published in the Journal of European Integration I have argued that the ECB has good reasons to downplay these ‘exchanges of views’ with national parliamentarians. Since its inception the ECB avoided listening to elected representatives other than those sitting in the European Parliament out of fear that this could negatively affect its fragile political independence. Now that the central bank is no longer a teenager – it just turned 20 years old – it seems much more comfortable facing politicians heads on. What are the drivers for the ECB’s sudden change of heart?

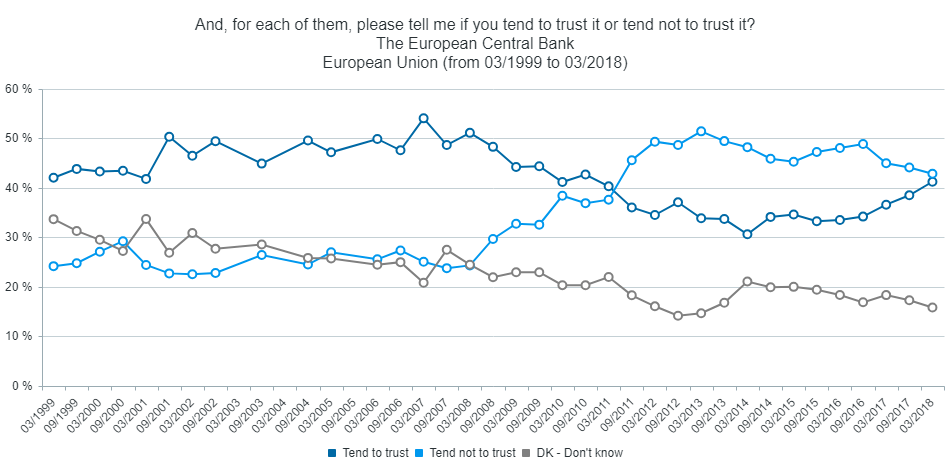

Three institutional developments are worth mentioning in the crisis context: (1) the ECB’s controversial role in the troika, (2) its unconventional monetary policy measures with quasi-fiscal repercussions for Eurozone member states (most notably, OMT), and (3) its new competences in micro-prudential supervision. Certainly, the first two factors have contributed to a massive increase in public distrust in the ECB (see Figure 1). At the same time, a debate ensued whether political independence of central banks was still appropriate given the distributive impact of its policies. Last but not least, the ECB seemed to be overburdened with its ever-widening mandate persistently undershooting its self-defined inflationary target during the crisis period.

Figure 1: Trust in the European Central Bank (1999 – 2018). Source: Interactive Eurobarometer

From the ECB’s perspective, visits to national parliaments seemed to be a potential remedy to counter some of these worrying trends. As the only supranational central bank that faces the challenging task to communicate to multiple national audiences, it becomes extremely important to penetrate the national monetary policy discourses of all Eurozone member states. Different Eurozone members often produce conflicting demands that render it even harder for the ECB to find a one-size-fits all solution satisfying the needs of everyone. Let’s remember that ‘whatever it takes’ was not unpopular across the entire eurozone. But as monetary policy became more targeted and the distributional impact was more visible, especially those countries that would have to shoulder the fiscal risk of the ECB’s unconventional monetary policy grew increasingly uncomfortable. Thus, it is not surprising that Draghi’s first visit was to the German Bundestag directly after the announcement of OMT.

Are some national parliament “more equal than others”?

But herein lies the problem. Draghi visited the Bundestag twice (in 2012 and again in 2016) creating the impression that some national parliaments are ‘more equal than others’. The visits took place in parliaments of member states that are the largest contributors to the ECB’s capital (i.e. for which the fiscal risk was highest). Countries under a fully-fledged financial assistance programme like Greece, Portugal and Cyprus have been left out. To be sure, it should be appreciated that the ECB has been willing to better explain its monetary policy decisions. Yet, the absence of clear template made each visit a matter of ad hoc negotiations revealing the Eurozone’s democratic deficit. This dismal state of affairs has been addressed at least for the supervisory arm of the ECB’s activities.

With the benefit of hindsight, the visits to national parliaments might not have produced the hoped-for benefits. After a visit to the Dutch House of Representatives, the Financial Times titled ‘Mario Draghi riled by Dutch MPs in a rare public grilling’. The appearances have undermined the ‘Monetary Dialogue’ hearings with the European Parliament as the exclusive locus for the ECB to discharge accountability. Visits to national parliaments have undoubtedly created a rivalling accountability structure.

They also turned out to be a careful balancing act. Draghi had to withdraw his offer to visit the Irish parliament when it appeared that his statement could be used as testimony in the Irish Joint Committee of Inquiry in the banking crisis – a parliamentary committee set up specifically to investigate the reasons why Ireland experienced a systemic banking crisis. This episode showed that visits to national parliaments can quickly turn into a slippery slope for the ECB.

While Draghi boldly declared in the Finnish Parliament that ‘our accountability towards the European Parliament does not exclude that there are also a number ad hoc interactions with national parliaments’, it would be better to keep the accountability framework simple rather than increase its complexity.

This could be achieved by focusing reform efforts on strengthening the ‘Monetary Dialogue’ by making it more accessible. National parliamentarians should have the right to question the ECB President but the European Parliament’s ECON Committee should act as the gatekeeper. Delegates from national parliaments could, for instance, be invited to the ‘Monetary Dialogue’. This would ensure that there are clear rules that guarantee equal access. It would prevent the ECB from instrumentalizing parliaments to consolidate its independence and lead to genuine accountability.

Tobias Tesche is a PhD Candidate in Political Science at the European University Institute in Florence, Italy. His research deals with the political economy of fiscal councils, the European banking union and the ECB. You can follow him on Twitter @tobias_tesche