A group of notable academics including Thomas Piketty and Michel Aglietta are calling for a more transparent and democratic process in the appointment of ECB board members.

The ECB’s Vice President Vincent Constancio is scheduled to be stepping down in 2018 as his term comes to an end. The process of appointing the next vice-president began today, setting off a lengthy and complex process appointing new board members following the departure of two-thirds of the central bank’s executive board over the next two years including the ECB’s president Mario Draghi at the end of 2019.

A front-runner is rumoured to be Luis de Guindos, the Minister of Economy and Competitiveness in Spain who was also the executive president for Spain and Portugal’s branch of the Lehman brothers during the financial crash. It is unclear why Guindos is a leading candidate other than his experience in banking for a disreputable company. The election process of ECB board members is more like a game of musical chairs where each country is seeking to increase its national influence reinforcing the opacity of the process.

Highlighting this very pertinent problem is a group of 25 academics including Thomas Piketty and Michel Aglietta. They wrote in Le Monde (also in English at VoxEurop) stressing the importance of transparency in nominating candidates as well as calling for a more democratic process:

“The nomination process does not have to be conducted in private… Nothing, in effect, is stopping finance ministers from making their decisions, and the reasons behind those decisions, public. Nothing is stopping candidates, those for the presidency most of all, from stepping forward in the coming months, being heard by national representatives, and stating their commitments.“

The group also suggests that the European Council should publicise its selection criteria and conditions for being an ECB board member. The European Parliament and national parliaments should have the opportunity to organise hearings with the various candidates to make sure they meet those criteria.

Another group of French academics echoed this call for a more transparent appointment process:

“We think that the upcoming nomination procedures should be more transparent and as open as possible, in order to nominate board members according to their competence and not depending on fragile geopolitic or political equilibriums.“

It is not only the manner in which board members are elected but the type of candidates who are nominated and selected. The board is predominantly made of older, white men who similar backgrounds in that they come from the financial sector or that they are academics. Syncrosity in action should not mean slotting in clones across the board. In 2012 a number of economists called for more gender balance in the ECB. The European Parliament’s chair of Economic and Monetary Affairs (ECON) also signaled he wants more gender balance within the ECB. It’s 2018 not 1958!

In the upcoming annual report on the ECB, the parliament calls for European Council to “submit shortlists of candidates so that Parliament can perform its institutional role in the appointment of the President, Vice-President and other executive board members of the ECB.”

A clear example of democratic deficit

The nomination process of ECB board members is a clear example of how the ECB is less democratic than other central banks. It is one of closed doors negotiations with little to no transparency and no legitimacy from the European Parliament whose role is only advisorial.

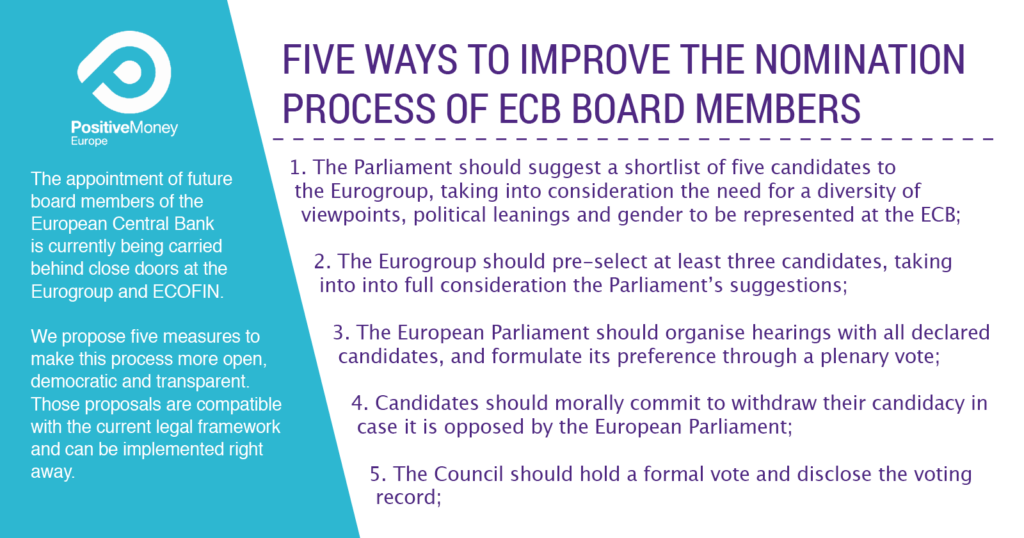

Positive Money is standing for more parliamentary scrutiny over the ECB. This includes on the decision-making process leading to the appointment to the ECB board . Instead of just giving their opinion on the one candidate pre-ordained by the European Council, the Parliament should hold a hearing with a shortlist of candidates proposed by the Council. At this stage it would vote in favour of its preferred candidate. This one of our 5 recommendations on how to improve the overall appointment procedure:

Beyond this, we believe the ECB would benefit from more diversity of political views, gender and backgrounds as these factors should play a more important role in standing on the ECB than an individual’s nationality – which should in theory be completely irrelevant.

Whilst expertise is an important factor, we think it should not be used as the only trait to judge a candidate’s merit for a board member role. Firstly, because there are plenty of experts among the 2,500 plus ECB workforce. Secondly, conventional monetary policies are being questioned. The ECB faces new challenges such as the low-inflation environment, technology, communicating directly with citizens, public representation, as well as internal management issues. This means the kind of expertise the ECB needs today might be different than many think. Simply put, the ECB needs fresher views on monetary policy not just economists who have spent their entire careers working with obsolete models and monetary theories.

A precedent for a more Democratic Eurozone

A body whose members all think alike are unable to meet these challenges in a dynamic and forward moving fashion. Reforming the appointment process would empower more public debate and reflections on the need for more diversity in high ranking positions at the ECB.

Today, candidates standing for the ECB board must be put forward by member states while in the UK anyone can push themselves, as former Chair of the Financial Services Authority Adair Turner did in 2014. A more open process would also favour a set of more diverse candidates.

The ECB is suffering from low public trust. Allowing greater transparency and democracy in the appointment process of its board members enables more fruitful exchanges between the EU’s governing institutions and the members elected to represent the public. It would also inaugurate better governance of the central bank’s monetary policies and set a precedent for a more democratic Eurozone as a whole.

Picture Credit CC: Wikipedia