In a report adopted this week, the European Parliament confirmed (once again) that the ECB must directly address climate change in its policies.

On Wednesday 12th, the European Parliament adopted its annual report on the European Central Bank. Although the report is mainly advisory, it allows the elected representatives in the European Parliament to evaluate the past and current activities of the ECB. In practice, this annual report has often been used by Members of the European Parliament to express criticism and formulate proposals for improving the ECB’s monetary policy.

This year’s report is extremely important since it coincides with the launch of the review of the ECB monetary policy framework, which should lead the ECB to look at its possible role for climate change. In this context, the vote represented an important political test on whether the ECB has the democratic backing to include climate considerations in the ECB’s mandate. This report is also important since Lagarde has committed to consult with the European Parliament during the review.

As in previous years, Positive Money Europe has been closely monitoring this report, including by engaging with the key MEPs involved in negotiating the report during the nearly six months of negotiations leading to the vote this week.

Since 2016, Positive Money Europe has been warning against the fact that the ECB’s quantitative easing strategy subsidizes polluting multinationals, and pressed the ECB to favor green investments instead. Later in 2019, we co-signed with 163 NGOs and experts an open letter to Christine Lagarde demanding the ECB to gradually eliminate carbon-intensive assets from its portfolios, starting with immediate divestment from coal-related assets.

As we explain below, the adoption of the report by Socialist Cypriot MEP Costas Mavrides, represents a key milestone for Positive Money Europe’s campaign on greening the European Central Bank.

MEPs confirm climate is in the ECB mandate

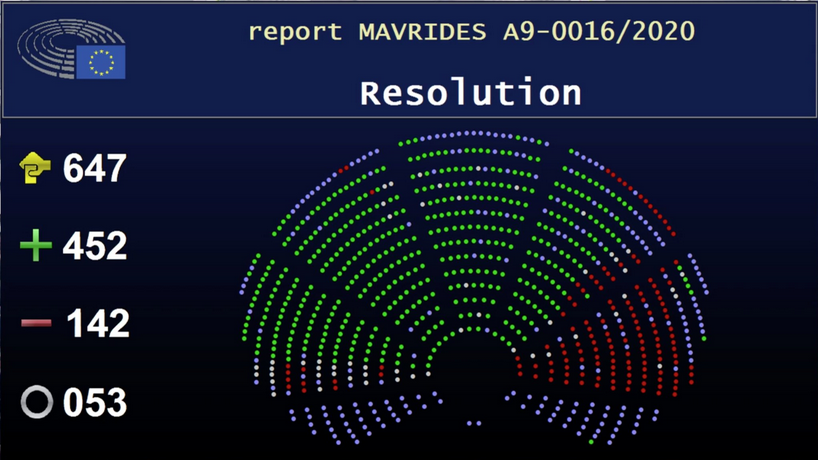

The most salient part of the Parliament’s report is the fact that MEPs overwhelmingly endorsed the responsibility of the ECB in the fight against climate change:

[The European Parliament] recalls that, as an EU institution, the ECB is bound by the Paris Agreement on climate change and that this should be reflected in its policies, while fully respecting its mandate and its independence.

By adopting this report with a big majority, the European Parliament has clearly indicated that it agrees in principle with Lagarde’s view that the ECB should address climate change as part of its mandate. Indeed, all mainstream groups, including the Greens, Socialists, Liberals, and the right-wing EPP group backed the report, while only far-right groups and some fractions of the radical left rejected the report.

This is quite a big breakthrough, given that in the past, centre-right groups in the Parliament used to oppose similar resolutions. This shift in attitude clearly indicates that the role of the ECB for climate change has now become a consensual idea.

ECB demands a real shift towards green investment

The Parliament also backs Lagarde’s commitment to deliver a “gradual transition to eliminate carbon assets’ from the ECB’s portfolio”. In fact, MEPs directly address the danger the corporate sector purchase programme (CSPP) poses to the environment, a core issue of our long-standing campaign for a green ECB.

However the Parliament’s report does not take a clear stance on how to implement such “gradual transition” in practice. It only alludes to a possible “framework for coordination between the ECB and the European Investment Bank.” (EIB)

While the Parliament’s text is not clear, this proposal could mean in practice that the ECB would commit to extending its ongoing purchases of EIB bonds issued to fund environmentally-friendly projects. At least, this was the proposal suggested by several groups in their previous amendments on this report. As we suggest here, the ECB could do this by operating a “green twist” in its balance sheet: it would gradually sell its €480bn of private-issued bonds (or simply allow them to run off) in exchange for long-term green bonds issued by the EIB. The timing for doing this has never been better as member states have recently agreed to turn the EIB into a European Climate Bank.

It’s high time the ECB shifts towards green investments, neutralising the financial and social risks related to the climate emergency. With this Parliament’s vote, our campaign has reached an important milestone by securing a political agreement on the fact that the ECB needs to look at climate change.

Moving forward, it will be critical that the ECB offers space for experts and NGOs to present our policy proposals during its strategic review. It is also key that the Parliament also increases its implication in this process, debating and evaluating how each of the ECB’s monetary instruments can be mobilized to best support the green transition.

Positive Money Europe will seek to make its contribution by pushing institutions to put those words into action, closely monitoring the next developments.

Full report available here