There is little point by forcing the economy to accelerate when the one thing we want is to slow down a virus contagion. Instead of blunt stimulus measures, the ECB must respond to the Coronavirus by launching targeted support for small companies.

As the Coronavirus keeps spreading across the World, economists and financial markets are increasingly worrying that a new recession is around the corner. This risk is materializing for two self-reinforcing reasons. On the one hand, consumption is going down as more and more people affected by the virus have to self-quarantine and stop working. Others reduce their consumption habits and therefore people are spending less. On the second hand, economic production is also slowing down as companies have to cancel public events, factories are suspending production and many workers are forced to stay home. What’s more, travel restrictions mean the global trade chain is also slowed down.

In short, we are witnessing reduction in both the “supply” (production of goods) and the demand side (consumption). Traditionally, economists would usually respond to such situations by boosting the economy at any cost. But the peculiarity of this crisis requires an equally careful response from macroeconomic policy. After all, this is first of all a sanitary crisis.

Safety first!

According to epidemic experts and health institutions, it is almost impossible to stop the contagion entirely. The real priority at this point is to avoid overcrowding hospitals, and to gain time for the scientific community to research, test, and finally produce remedies and vaccines for the population. To do so, we must slow down the contagion as much as possible.

How to play your part minimising the impact of Covid-19, in one simple gif, thanks to @XTOTL & @SiouxsieW https://t.co/s2331Up39n pic.twitter.com/IDqnxAs5z5

— The Spinoff (@TheSpinoffTV) March 8, 2020

Of course, social and health authorities are first in line to cope with the crisis. Governments should ensure that hospitals have all the financial resources they need to to increase their intensive care facilities and the number of beds. To this effect, the decision by all heads of States to relax the EU fiscal rules is to be welcomed.

Furthermore, governments and companies are rightly taking measures such as closing non-essential public areas and forbidding big meetings, encouraging people to work from home, and by compensating people who cannot work because of quarantine measures. It is indeed vital that people affected by the virus do stay at home, despite their financial necessity to work. Governments should ensure that social benefits are being paid to people as a compensation for the closure of their companies, schools, nurseries, and other quarantine measures.

So, what can the ECB do?

Only scientists and doctors can really help fight the virus – while all of us can help slow down the contagion. What central banks have to do is to ensure that the temporary sanitary crisis does not turn into a long-lasting recession, putting millions of people unemployed and making the poor poorer.

Does it mean the ECB and governments should plan a big stimulus programme? We take a much more nuanced view. Indeed, attempting to slow down the contagion of the virus while forcing the economic activity to accelerate is at best paradoxical if not counter-productive.

In this sense, blunt measures such as more quantitative easing programmes and more negative interest rate are probably misguided responses. Similarly, although we strongly believe in the merits of helicopter money, this measure is less appropriate when the supply of goods and services is limited, as it is the case now. What’s more, triggering helicopter money now would likely be ineffective, as consumers are less willing to spend anyway. However, direct transfers to households could be very effective in stimulating the economy when the Coronavirus crisis fades away and the productive capacity of the economy goes back to normal.

Targeted approach

A more targeted approach is required. Instead of a blunt short term stimulus, the main priority of macroeconomic policy is to avoid long-term damage on the economy, by preventing companies from going bust and letting people off because of the short-term effects of the crisis. As several governments in Europe have already announced, this can be done by adopting temporary suspension of tax and debts repayments for households and SMEs, as the Italian government just announced. Such measures are needed to make sure banks are not hassling small businesses to pay back loans while they face a drop in sales due to the virus.

The European Central Bank can also support this strategy by modifying the design of its Targeted-Long-Term-Refinancing operations (TLTROs). For once, this giant subsidy programme could prove useful not just for banks. For example the ECB could reduce the interest rate of TLTROs for banks under condition that they provide interest-free short term bridge loans to small and medium sized companies which are affected by the virus crisis. A similar measure was announced by the Bank of England yesterday, which proves this is feasible.

The baseline is that governments should keep taking all the measures they have to take in order to slow down the contagion, regardless of their economic cost for growth or for governments deficits on the short term. People should be compensated if they have to stop working, and companies should be protected from closing down on the short run. The ECB can support this approach by using its existing instruments such as TLTROs. Ultimately, it is clear that the survival of millions of people should matter more than a few digits increase in public spending. The temporary drop in growth and global trade is a “necessary evil” to make the global sanitary response effective, so central banks should refrain from large scale stimulus measures on the short run while preparing to deploy bold measures to stimulate a sustainable and fair recovery, once the sanitary crisis has been defeated .

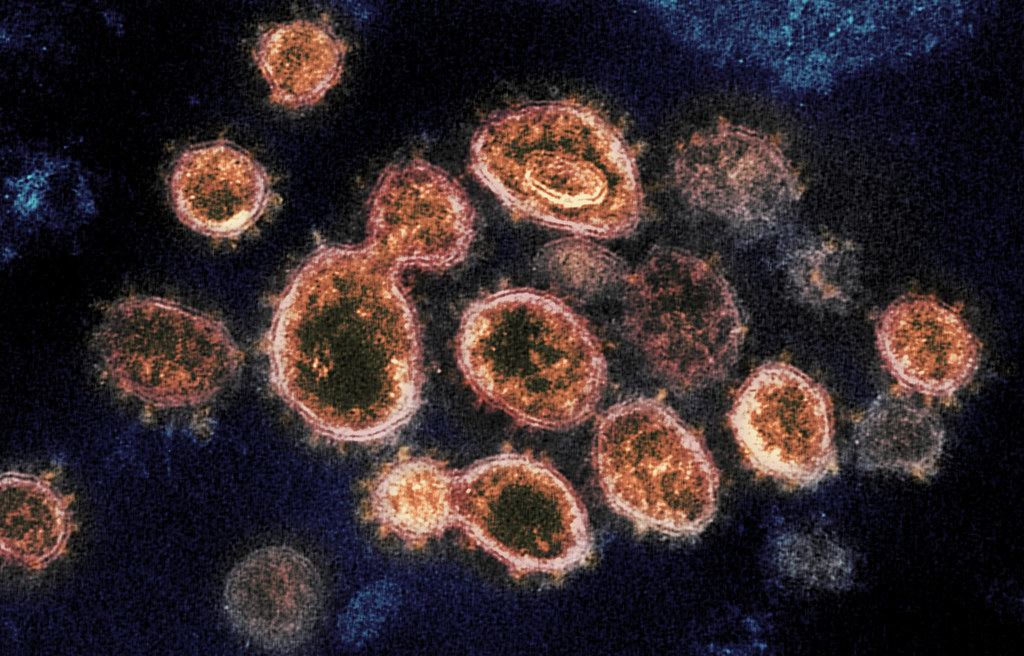

Picture credit: NIH Image Gallery (public domain)

Very good analysis – except how will people pay their car loans, their rent, their credit cards … I still think that will take some helicopter money. I would suggest suspending employment insurance and make a universal payment to everyone of an equivalent amount using the income tax records. I would also suggest topping up social insurance payments to the equivalent amount. Some might be reclaimed through taxes at some point for the top 10% of income earners

Hi Joe, all good ideas, which governments can implement, not the ECB 😉

Jourdan, things have changed astonishingly. Many variations of my ruminations are being implemented or proposed.