Responding to a consultation launched by the European Central Bank on the future introduction a digital euro, Positive Money Europe outlines how a digital euro could be designed so it truly benefits people.

Last year, the European Central Bank launched a consultation in which it asked for views on a digital euro. A digital euro would be the digital equivalent of cash, and the ECB is currently preparing for its potential implementation. The survey included questions on the challenges associated with a digital euro, the role of banks, the managing of the quantity of digital euros and the role organisations who responded could play.

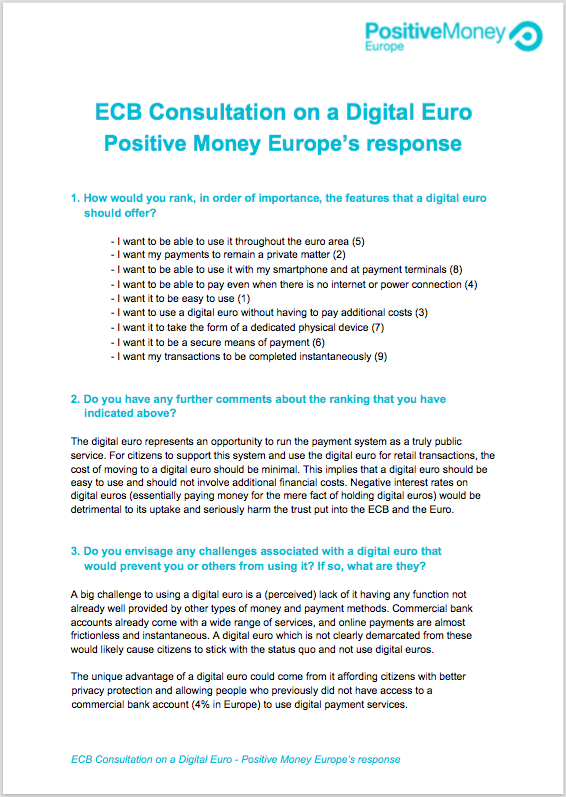

As Positive Money Europe, we submitted our response to the survey. Here are our main points:

We’re in favour of a digital euro that protects privacy alongside cash

We’re in favour of a digital euro that protects privacy alongside cash

We believe that your ability to use notes and coins should be protected. As such, a digital euro should only complement cash and not replace it. Furthermore, a digital euro should be designed to ensure as much privacy as possible. While it may be technologically impossible for a digital euro to have cash-like anonymity (a further reason why cash should not be abolished), it is possible to make it more privacy-protecting than the commercial bank money most of us are currently using. For example, a physical payment device where the digital euro value is stored locally would help to protect personal data.

A digital euro should help increase financial inclusion, and therefore not depend exclusively on private banks

We are skeptical of the ECB’s preference to rely exclusively on commercial banks and other private institutions to provide front-end payment services, as this approach would undermine financial inclusion. We believe citizens should not be forced to depend on profit-seeking companies to access a digital euro and related basic services. Therefore, citizens must have the option to open a digital euro account through a publicly-owned institution, such as national central banks. This would help people who previously did not have access to a commercial bank account (4% in Europe) to use digital payment services.

The added value of a digital euro depends on it being significantly different from commercial bank money

A big challenge to using a digital euro is a perceived lack of additional benefits compared to other types of money and payment methods. A digital euro that is not clearly distinguished from these could cause citizens to stick with the status quo and not use digital euros. To prevent this, the ECB should highlight the key advantage of a digital euro over bank deposits, namely the provision of an ultimately safe form of money which is directly backed by the central bank. It should also design a digital euro in a way that affords better privacy protection to individuals and maximises financial inclusion.

A digital euro should help transform the banking system

A digital euro is not just another payment system, but an opportunity to improve how the banking system works, making it more efficient, fair and resilient. The introduction of a digital euro would improve competition in the payments market by setting a universal minimum standard of service for the payments sector. Furthermore, it could make the banking and financial system more stable, for example by crowding out unstable shadow money that has been at the core of past financial crises. Yet, what the ECB is currently considering, i.e. starkly restricting the convertibility of a digital euro, for example through quantity limits or tiered remuneration, is not only unnecessary but also undesirable.

A digital euro should help modernise monetary policy

A digital euro should be designed to enhance innovative monetary policies, such as direct monetary transfers (helicopter money). This would allow the ECB to bypass financial markets and provide money directly to citizens. The stimulating effects for the Eurozone economy (which are needed to combat the coronavirus-induced economic crisis) would be greater than many current monetary policy measures such as Quantitative Easing.

vos remarques en réponse à la consultation sont bien fondées, reste néanmoins un obstacle de taille : la BCE elle-même dont l’objectif ultime demeure le statut quo à savoir une politique monétaire ordonnée à prédominance du marché, et que fait le marché roi si peu régulé? il enrichit les riches jusqu’à l’écœurement, appauvri les plus pauvres, retarde l’action contre le réchauffement climatique, et soumets les peuples, avec la bénédiction des gouvernements.