A new study finds that ECB’s monetary policy affects the wage share of companies and thereby the distribution of income between workers and shareholders. Given that these effects differ by firm characteristics, monetary policy has uneven effects across the euro area. To tackle this, more targeted monetary policy tools should be developed.

This opinion piece was adapted from an article by Jan Philipp Fritsche previously published in German on Makronom. The views expressed by the author may not represent the views of Positive Money Europe.

Central bankers are currently paying much attention to wages due to concerns that pandemic-related elevated inflation rates will become persistent. ECB President Lagarde recently stressed that a higher-than-expected rise in wages could raise inflation which might require the ECB to tighten its monetary policy. The ECB’s main instrument for doing so is the short-term interest rate. This works partly by affecting the amount that companies spend on wages and salaries, relative to their value-added. In other words, it affects the wage share of firms. As wages and salaries are the main source of income for most workers and hence determine their purchasing power, wages and salaries affect demand and ultimately the inflation rate.

How interest rate changes affect the wage share is relevant for assessing the redistributive effects of monetary policy as well as its effectiveness. New-Keynesian models postulate that contractionary monetary policy decreases the wage share (and vice versa). However, there is virtually no empirical evidence on this.

Interest rate hikes redistribute income from workers to shareholders

A new empirical study, analysing 14 million observations from more than two million European firms from 1999 till 2017, finds that an exemplary interest rate hike of 0.25% significantly lowers the wage share. The wage share falls by about half a percentage point in the first year after an increase. Increasing interest rates produces the opposite effect.

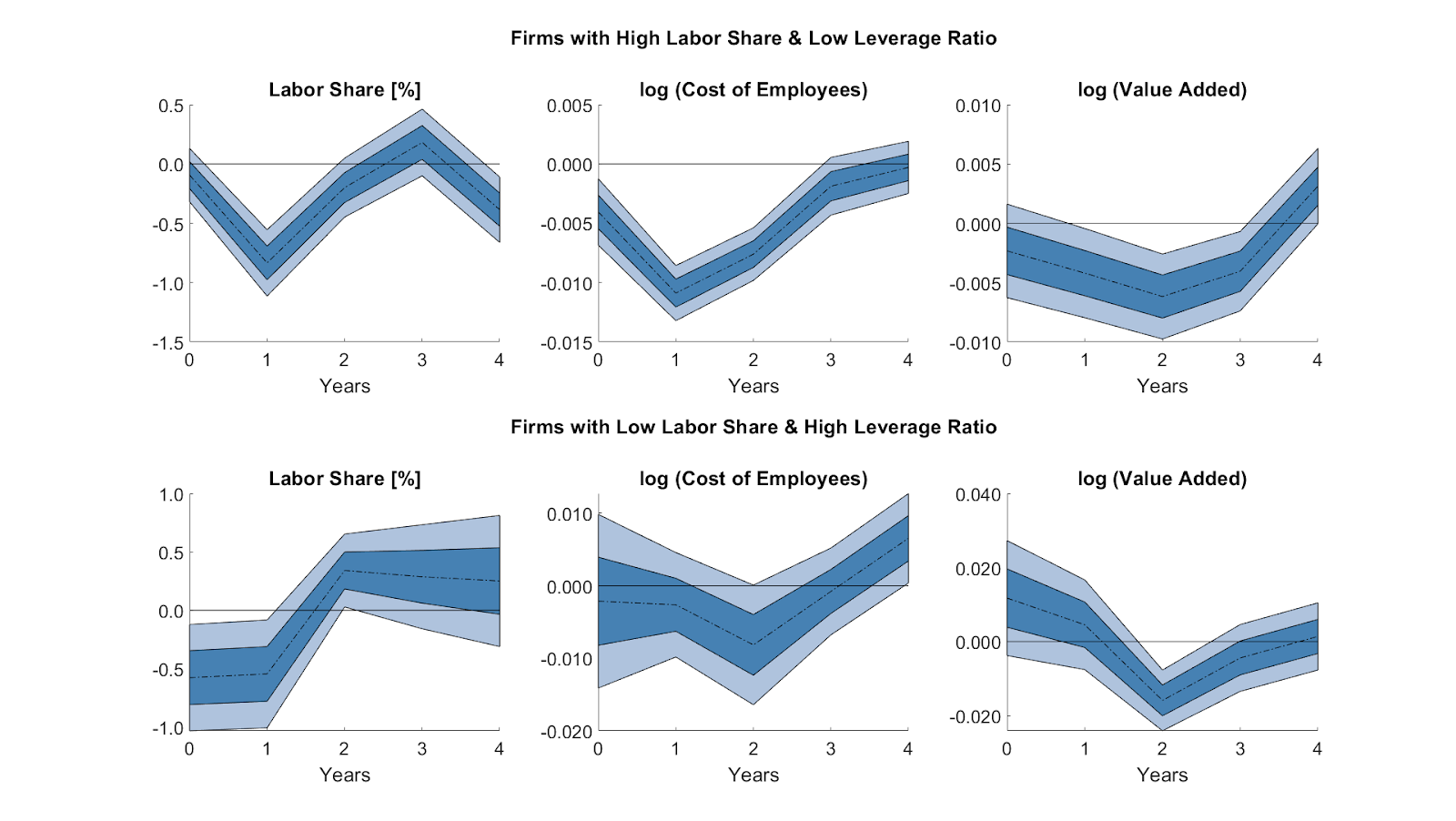

The wage-share decreasing effects are particularly pronounced for companies with a high labour share (e.g, a research firm that has a relatively high number of employees per value-added) and for companies with a high leverage ratio (e.g., a tobacco production company which has a relatively high number of liabilities per owned assets). For labour-intensive firms, the interest rate hike leads firms to cut the costs they incur from paying their employees which translates into a lower wage share. For companies with a high leverage ratio, the wage share also decreases immediately after the increase in interest rates, but this doesn’t come with reducing the absolute amount of money spent on wages and salaries. Instead, this is driven by changes to a company’s value-added which can even increase in the short term due to selling off inventory or taking balance sheet-reducing or profitability-increasing steps.

Graph 1: The reaction of firms’ wage (/labor) share, the cost of employees, and the value-added to an interest-rate hike of 0.25%

Redistributional effects differ by country and region

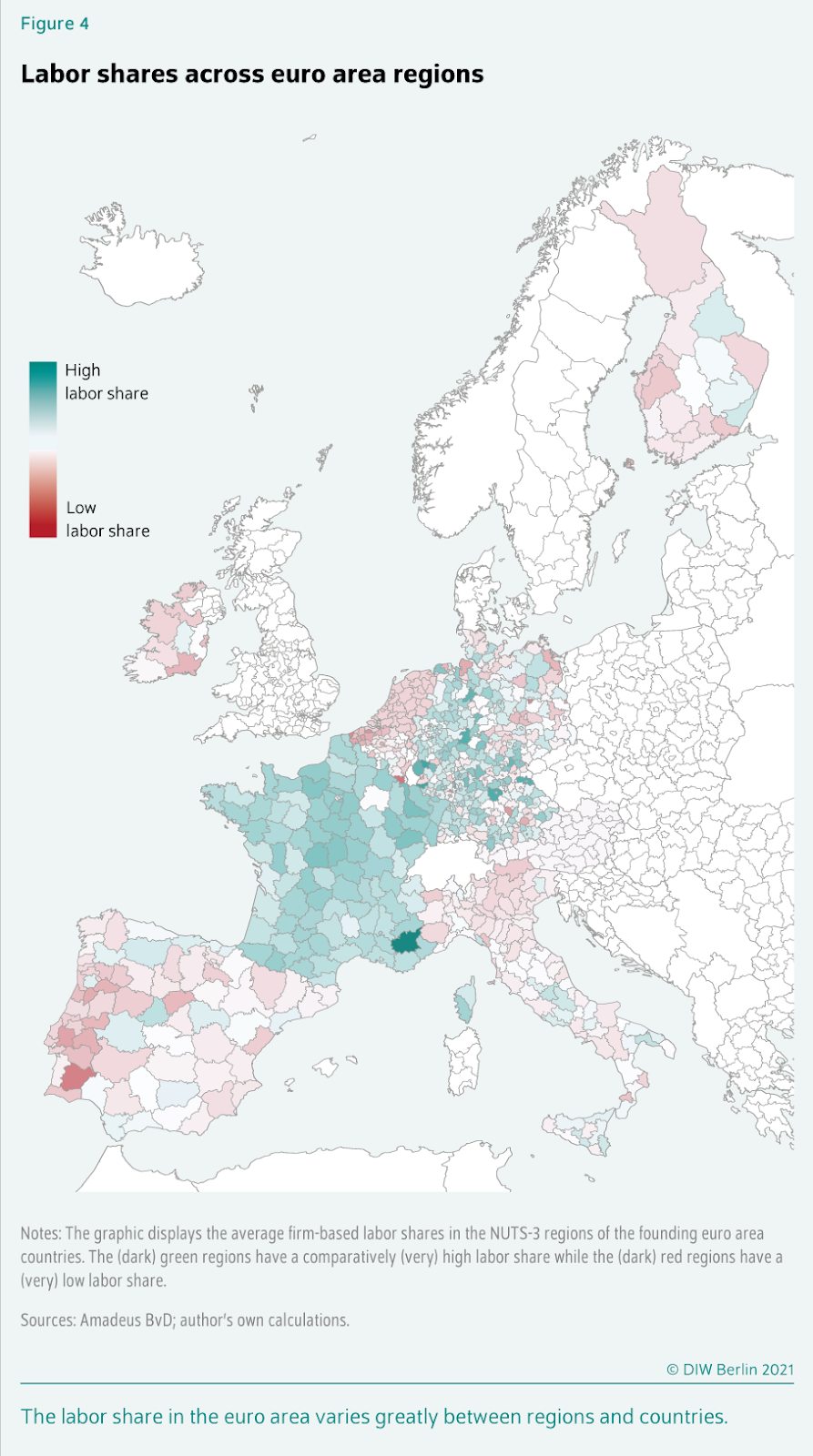

As the level of firms’ wage share is highly relevant for the strength of monetary policy, the dispersion of labour-intensive companies shapes the transmission of monetary policy. In the euro area, labour-intensive firms are spread unevenly among jurisdictions (see graphic 2). This means that the ECB’s monetary policy has a stronger impact in those countries and regions where companies have particularly labour-intensive production, as for example in France, and a more moderate effect in regions with low wage rates, such as in Portugal. As a result, macroeconomic imbalances might occur. In the worst case, this heterogeneity could lead to a divergence of business cycles, making it more difficult for the ECB to ensure price stability.

Graphic 2: Geographical distribution of firms with high wage (/labor) shares

A better targeted monetary policy would help

To tackle the uneven effects and resulting imbalances of interest rate changes, the ECB could tailor its monetary policy directly to companies. This could be achieved by, for example, increasingly using targeted lending programmes, such as the longer-term refinancing operations (TLTROs), which are designed to facilitate lending to businesses and households. While the TLTROs are tied to the amount of lending, new programmes could also take into account the characteristics of the businesses to which banks lend. For example, central banks could open up special credit lines for banks that target loans to small and medium-sized companies with high labour intensities. Furthermore, the ECB could bypass the intermediary financial market and directly interact with businesses and households, potentially through making use of not-yet-existing retail digital euro accounts.

Nevertheless, it is unlikely that the ECB will abandon interest rate changes for the sake of the above instruments in the near future. Hence, for monetary policy to produce more symmetric effects, with the ECB toolkit remaining unchanged, policymakers should push for convergence of labour and capital markets in the Eurozone. Particularly the labour markets should be better integrated and labour market institutions harmonised. This would reduce the variety of firms’ wage shares in the Eurozone and make the transmission of monetary policy more even.

As a more fundamental issue, policymakers should review the redistributive effects between workers and shareholders of interest rate changes and see if they are, overall, desirable. If monetary policy is meant to protect workers’ wallets from rising inflation rates by increasing interest rates, but at the same time interest rate increases redistribute the protected income to shareholders of the enterprises, this could lead to avoidable tensions.