A new study traces how climate change became a topic in Europe’s monetary policy. Utilising a novel and extensive dataset, it shows how the European Parliament, early on, called for a greener monetary policy and eventually allied with members of the ECB to forge a consensus on monetary policy and climate change. The study was financially supported by Positive Money Europe and authored by Dr. Elsa Massoc, a postdoctoral researcher at the Center for the Advanced Studies of Law and Finance.

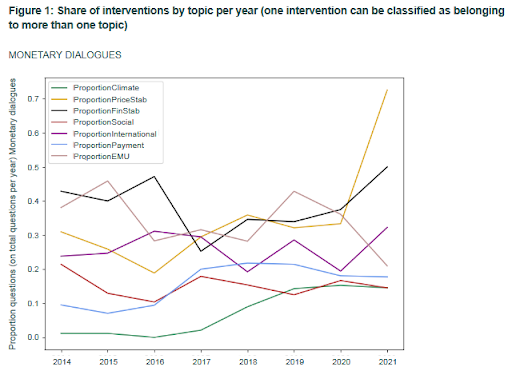

In the last few years, climate change has jumped to the top of the agenda in debates on the ECB. This is partly due to the leadership of President Christine Lagarde but also due to the pressure put on the ECB by elected representatives – a factor often forgotten. Already in 2018, the European Parliament called upon the ECB to align itself with the Paris Agreement. Since then, in the various accountability fora with ECB officials (the monetary dialogues, the written questions, the resolution debates), the number of MEPs’ interventions on climate change has starkly increased, in particular thanks to by female parliamentarians.

How might this pressure from the Parliament have affected the European Central Bank? The qualitative analysis in the paper sheds light on the discursive patterns of (co-)movement between MEPs and ECB officials.

The first case study: market neutrality. The concept describes the principle according to which the ECB buys corporate bonds such that the composition in its portfolio always reflects the composition of bonds in the financial market. This principle, which commits the ECB to disproportionately favour emission-intensive companies in its bond purchases, was the first line of attack for many MEPs. The research paper shows how ECB officials took up MEPs’ criticism and included it in its new strategy, hence showing an example of how parliamentary pressure might have affected a policy change at the ECB.

The second case study: justifying actions on climate change under the first objective of price stability OR the secondary objective of supporting the general economic policies in the EU. The qualitative analysis suggests that, after an initial state of indecisiveness on how to legally justify actions on climate change, the position to mostly highlight the price stability obligations won out. This dominant emphasis on price stability as a legal rationale for considering climate change emerged from within the ECB. It then got also increasingly picked up by MEPs who might have realised that it allows them gain the approval of conservative parliamentarians opposed to the ECB acting on climate.

The upshot of the paper: While the ECB’s position on climate change represents the successful emergence of a cross-institutional consensus, this consensus has been built through pragmatic bargaining, and hence is of a precarious nature. It doesn’t reflect a strongly institutionalised commitment and playbook on climate change and monetary policy. The current situation, where political entrepreneurs argue to de-prioritise climate change and focus exclusively on a narrow definition of price stability shows that the political battle on green monetary policy is far from over.

Massoc, E. C. (2022) “Climate change versus price stability. How ‘green’ central bankers and Members of the European Parliament became pragmatic (yet precarious) bedfellows”, Positive Money Europe, https://www.positivemoney.eu/wp-content/uploads/2022/06/Climate-change-versus-price-stability.pdf.

The dataset underlying the research paper can be accessed here.