The latest ECB climate stress test shows that banks could face a wave of insolvencies on their mortgage lending as high energy prices hit consumers with energy-inefficient homes. Banks’ unpreparedness to collect data on the energy efficiency of their real estate exposures exacerbates this risk even more. This is a wake-up call for the EU and governments to urgently strengthen supervision and oblige banks to unlock finance for the renovation wave.

On July 8th, the ECB published the results of their climate stress test, an exercise involving 108 banks across Europe aimed at understanding how climate change could impact their business in the next 30 years.

Under the stress test exercise, the banks’ lending portfolios are confronted with various orderly and disorderly transition scenarios, including extreme weather events and energy price shocks. By simulating these scenarios, the stress test can model the potential losses that will occur on the banks’ balance sheets.

Without surprise, the results show that banks still do not pay enough attention to climate risks, and that they have managed very little improvement since the previous exercise conducted in 2020.

For the first time, the stress test methodology incorporated an analysis of how banks are exposed to risks of mortgage default by factoring in the energy performance of buildings. The participating banks thus had to input into the stress test model information on the energy efficiency of their mortgage holders’ houses, such as energy performance certificates (EPCs), or by using proxy data (such as energy bill payments, date of construction of the buildings, or the size of the real estate property).

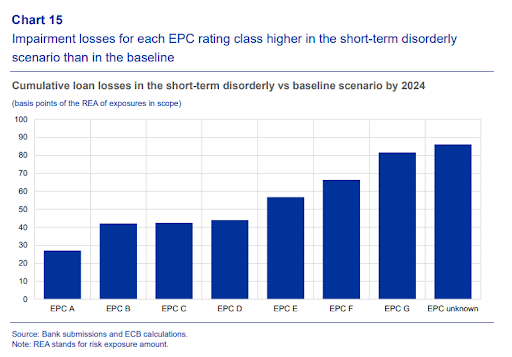

The results show a clear correlation between the energy efficiency of real estate properties and credit risks, with the latter being three times higher for a property with an EPC score of G than for those with an A score, as shown by the chart below.

Why energy efficiency matters for banks

The link between energy efficiency and credit risks can be explained by the fact that households who have less well insulated homes are statistically those with a lower income level, and also with more debt leverage (loan to value ratios). As a consequence, those households are the most vulnerable to energy price shocks, as they face disproportionately higher energy bills with lower incomes to sustain these higher costs. When families start having difficulties paying their utility bills, they will likely have similar difficulties meeting their mortgage repayments deadlines. This in turn becomes a credit risk for the banks, and a potential source of financial instability at the macroeconomic level.

This finding is not really a surprise, since it echoes the research literature on the topic, and the conclusion of a recent paper by the European Banking Authority and by the National Bank of Belgium. It is nonetheless the first time that the ECB acknowledges it.

Today’s energy crisis is ahead of the ECB’s scenarios

The risks pointed out above are not just theoretical, but are a solid concern in today’s real-time situation. As the ECB recognises, the war in Ukraine has produced a higher gas price increase and a stronger recessionary effect compared to the initial analysis. In other words, today’s situation is likely worse than the ECB imagined when designing the stress test methodology.

Banks are unprepared to address climate risks

It is therefore urgent for banks to start addressing the issue. But the stress test also reveals how unprepared they are to identify the credit risks stemming from low energy efficiency levels.

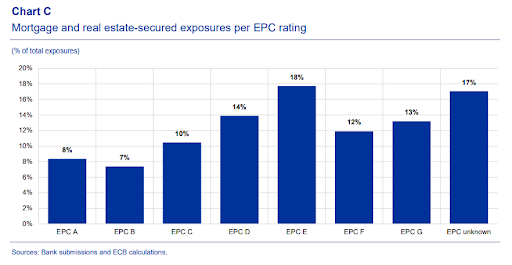

Indeed the results showed that 65% of banks do not collect EPCs and, to establish the energy performance of a property, they need to rely on proxies. The ECB themselves highlighted that these data are not robust enough given the number of assumptions that banks need to make. Moreover, for 17% of their mortgage lending, banks did not have any meaningful data at all, so they could not even use proxies. In other words, energy efficiency is a big blind spot for banks.

The lack of data combined with the weakness of banks’ methodology relying on proxies wave a red flag: risks can be far greater than the climate stress test suggests and ⅔ of banks may not fully understand the magnitude of their mortgage portfolio risk exposure, let alone address it.

A wake-up call for banks to help homeowners to renovate

The climate stress test confirmed that banks expose themselves to credit risks when financing the purchase of energy inefficiency homes, and that the losses they incur can be far greater than what projections estimate. The ECB made it clear that this climate stress test is only a learning exercise for banks and that no capital adjustments will follow at this stage. But the data we see today show that banks should take immediate steps to protect their balance sheet.

A logical way to reduce exposure to these types of climate change risks is to improve the energy efficiency of the concerned properties. Renovating them would prevent these risks from materialising in the first place, as it would significantly reduce the impact of energy shocks on households’ debt-servicing capacity.

Banks must develop strategies to help their consumers renovate their homes and make sure the worst-performing buildings, and therefore the riskiest assets, are addressed with utmost priority. To incentivise people to take up renovation loans and mortgages, banks should develop affordable lending products that significantly reduce the cost of borrowing and allow people to immediately benefit from savings on their energy bills.

In the middle of an energy shock and ahead of the uncertainty on the development of the war in Ukraine and the further impact it may have on energy prices during the coming winter, banks have no time to waste and regulators should step up to make sure banks act fast enough to contain this emergency. Some of the legislation needed to address the risks exposed by the climate stress test is already in the pipeline.

The Energy Performance of Buildings Directive proposal and the EU RePower plan are asking banks to increase the median energy performance of their mortgage portfolios through the newly introduced Mortgage Portfolio Standard mechanism. In other words, banks may be required to offer more renovation and green mortgages to support the green transition and help achieve energy independence. EU institutions need to include the Mortgage Portfolio Standard in the revised directive and make sure that, when implemented at the national level, Member States apply ambitious targets for banks to improve the median energy performance of their mortgage portfolio. To make this possible, the EU Commission must approve the European Banking Authority’s proposal that requires banks to collect and disclose EPCs data.

Other initiatives can be taken to offer affordable lending products and reach out to the largest numbers of consumers. For instance, both national governments and the EU could create a guarantee fund to offset default risks and reduce loans’ interest rates. The European Central Bank has also the power to improve the affordability of renovation loans by applying a green discount rate on the refinancing operations to banks, under the condition that they offer zero-percent loans to consumers for energy-efficient renovations.

These demands are part of our Unlock campaign, calling on the EU and national governments to unlock affordable public and private financial solutions for green home renovation. Renovating our buildings is a win-win solution that protects banks’ balance sheets and the stability of the financial system from climate-related transition risks, it shields households’ finances from the volatility of energy prices, and it gives a chance to the future of our planet. Banks need to step up and do their fair share to be part of the solution.