Eurosystem national central banks have very different procedures when it comes to reporting to political authorities, and are less accountable than the European Central Bank (ECB), a new research paper commissioned by Positive Money Europe shows. The Bundesbank has the weakest degree of accountability, while Greece, Lithuania, Estonia and Belgium emerge as the countries with the most accountable central banks.

A consensus view in economics is that independent central banks should have a high degree of accountability to political institutions and the public, in order to ensure their democratic legitimacy. Accountability is the obligation for a central bank to give account of, explain and justify its actions and decisions, and take responsibility for any fault or damage. Central bank accountability is usually exercised by comparing their activity to criteria set by democratic institutions, such as parliaments or governments.

In the Eurozone, the ECB is mainly accountable to the EU institutions represented by the European Parliament and the Eurogroup. Although these rules are not written in the EU Treaty, in practice the ECB’s accountability is exercised by the ECB President attending frequent hearings in the Parliament’s Committee on Economic and Monetary Affairs (ECON). MEPs also have the right to submit written questions to the ECB, and they vote every year on a report to evaluate the ECB’s activities. Positive Money Europe has contributed to this debate, and recently the EU Parliament itself has been demanding to review the accountability framework.

But while the relationship between the European Parliament and the ECB has been extensively debated, a lot less attention has been focused on the role of the 20 national central banks within the Eurozone. Indeed, although the ECB coordinates monetary policy in the Eurozone, its decisions are made by the Governing Council, which gathers the governors of all national central banks alongside the six members of the ECB’s executive board.

Given this peculiar power structure, assessing the quality of the accountability of the ECB requires a holistic understanding of how each of these national central banks are accountable to their own national public regarding the decisions they contribute to as members of the ECB’s Governing Council.

To fill this gap in the academic literature, Positive Money Europe teamed up with two researchers: Adriano do Vale and Léo Malherbe. In order to compare the accountability of Eurosystem national central banks, the authors adapted a research methodology developed in 2009 by Bernard J. Laurens, then Deputy Chief of the Monetary and Capital Markets Department of the International Monetary Fund (IMF), and his co-authors. Using this methodology, the authors analysed the accountability channels of nearly all national central banks (with the exception of Croatia), including by looking at the legal dispositions around appointment processes and parliament hearings.

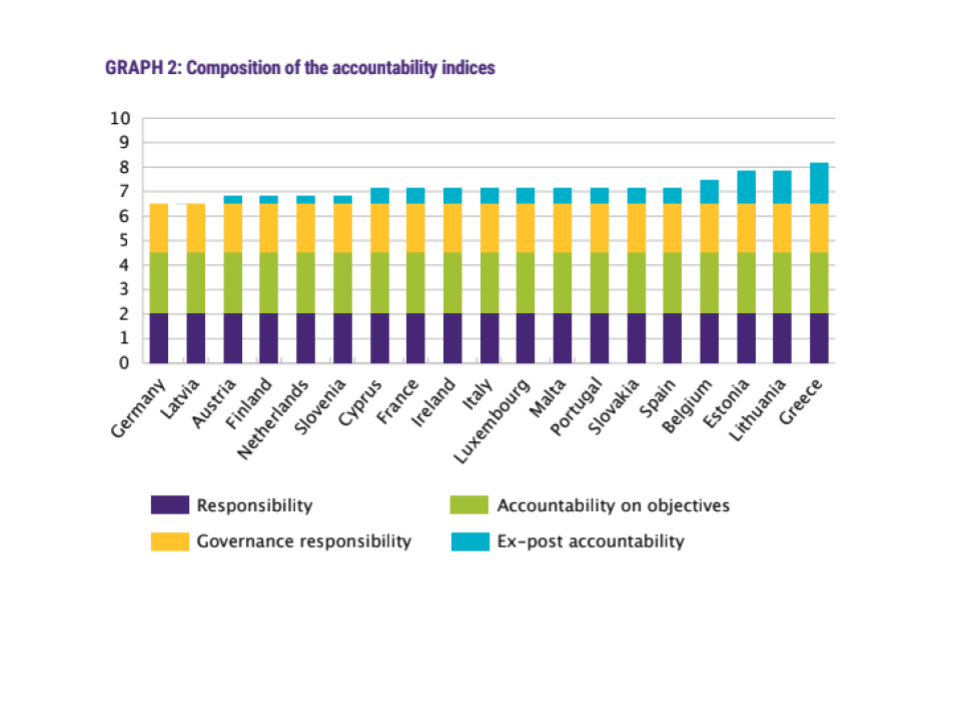

While all national central banks share the same characteristics with regard to their mandate (due to their membership in the Eurosystem), we observe significant differences in terms of “ex-post” accountability between central banks, as shown in this chart [1]:

Overall, the most important findings are:

- Only a minority of central bank governors are legally obliged to account for their actions in parliamentary hearings.

- Germany’s Bundesbank is the least accountable central banks, as it holds no reporting obligations to any political authority as of December 2022 [1]

- On the contrary, Greece, Lithuania, Estonia, and Belgium emerge as the most accountable central banks.

- All Eurosystem national central banks are less accountable than the European Central Bank itself

To reference this report, please use the following suggested citation:

do Vale, Adriano & Malherbe, Léo (2023). “Shedding Light on a Blind Spot: New Evidence on the Accountability of Eurosystem National Central Banks”. Positive Money Europe. http://www.positivemoney.eu/wp-content/uploads/2023/04/Shedding-light-on-a-Blind-Spot.pdf

[1] This article was updated to reflect that as of January 2023, a new Law regulating the Latvijas Banka (Bank of Latvia) came into force. Article 83 of this new law provides greater accountability provisions, in particular the presentation of the Bank’s annual report to the Parliament, regular appearance to the Parliament’s relevant committee, and a framework for written questions. Since these improvements were carried out after the cut-off date of the research report, these are not reflected in the analysis.