How banks are making billions thanks to ECB rate hikes

Windfall profits for banks are the consequence of ECB rate hikes.

Windfall profits for banks are the consequence of ECB rate hikes.

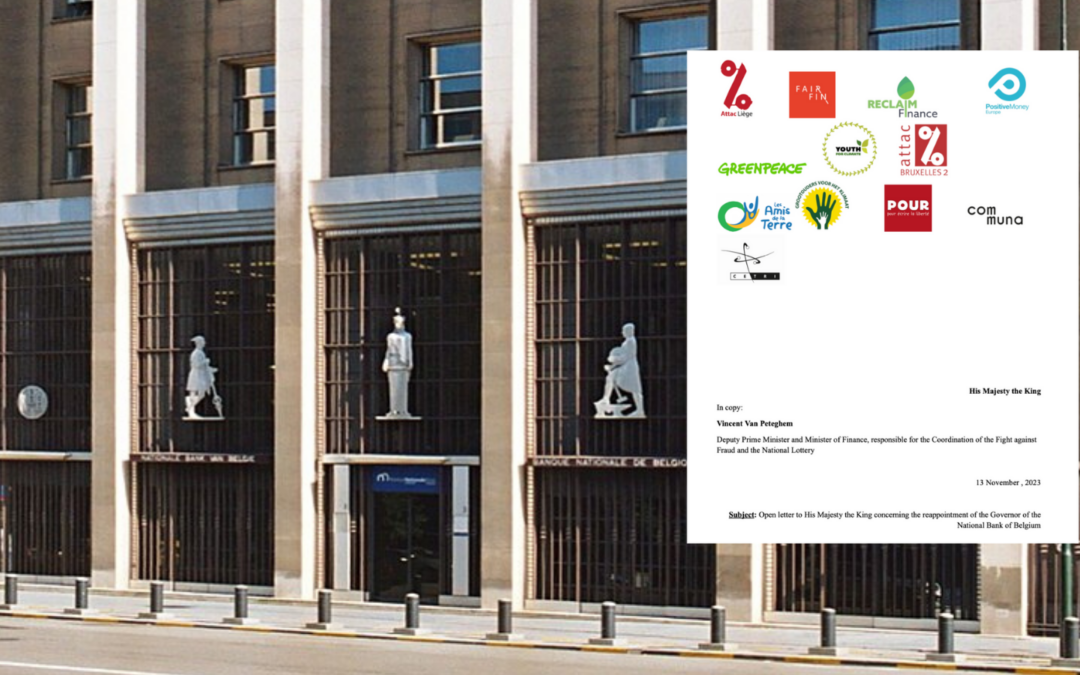

Today with more than a dozen NGOs specialising in climate and environmental issues, we sent a letter to King Philippe and Finance Minister Vincent Van Peteghem. We are requesting the appointment of a Governor of the National Bank of Belgium who is equipped to meet the challenges of climate change.

Get the ECB interest rates explained in plain terms! Discover more with the latest from our explainer series!

Read our explainer series on central banking and grasp the basics needed to understand this key institution!

Can the ECB both tackle inflation and protect green investments?

As a supporter, you’re at the heart of everything we do. We’d love to keep you updated about our exciting work and the ways you can help, including campaigns and events that you might be interested in. We promise never to sell or swap your details and you can change your preferences at any time. To do so, simply call +32 2 880 04 34 or email info@positivemoney.eu