by Positive Money Europe | Apr 4, 2023

The recent banking crisis shows that the financial system is broken. A digital euro designed for the people, not for private companies, could be the beginning of a more stable and safer public banking option.

by Positive Money Europe | Mar 21, 2023

We need a new financial system that serves people over private interests

by Positive Money Europe | Mar 14, 2023

The EPBD includes unprecedented energy efficiency standard on mortgages to unlock the renovation wave

by Adua Dalla Costa | Feb 16, 2023

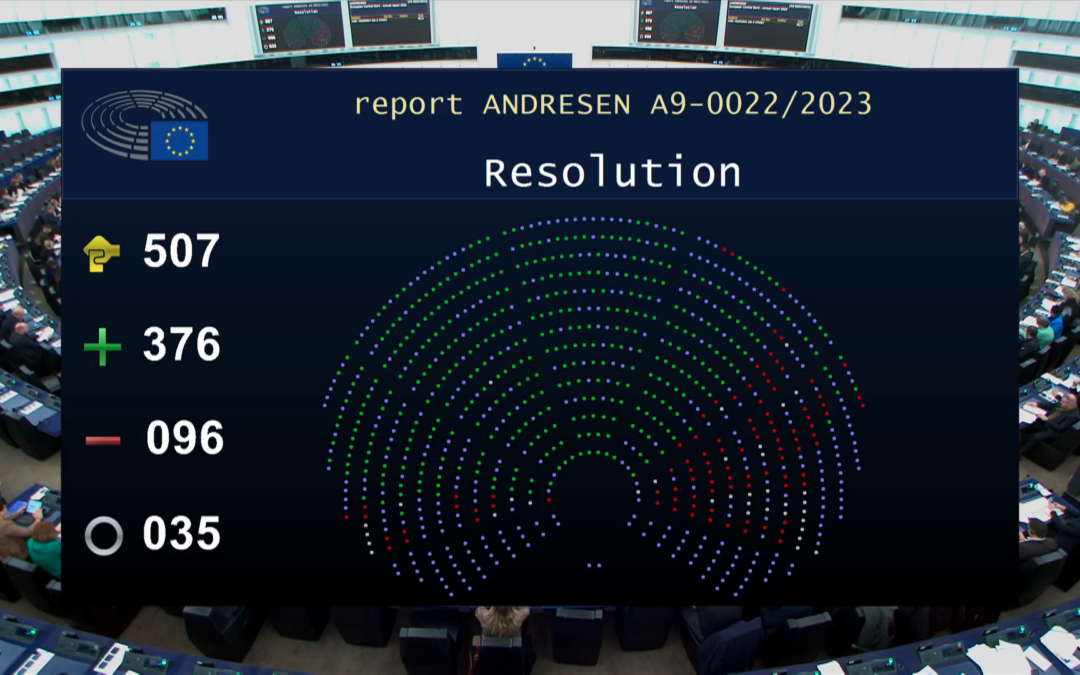

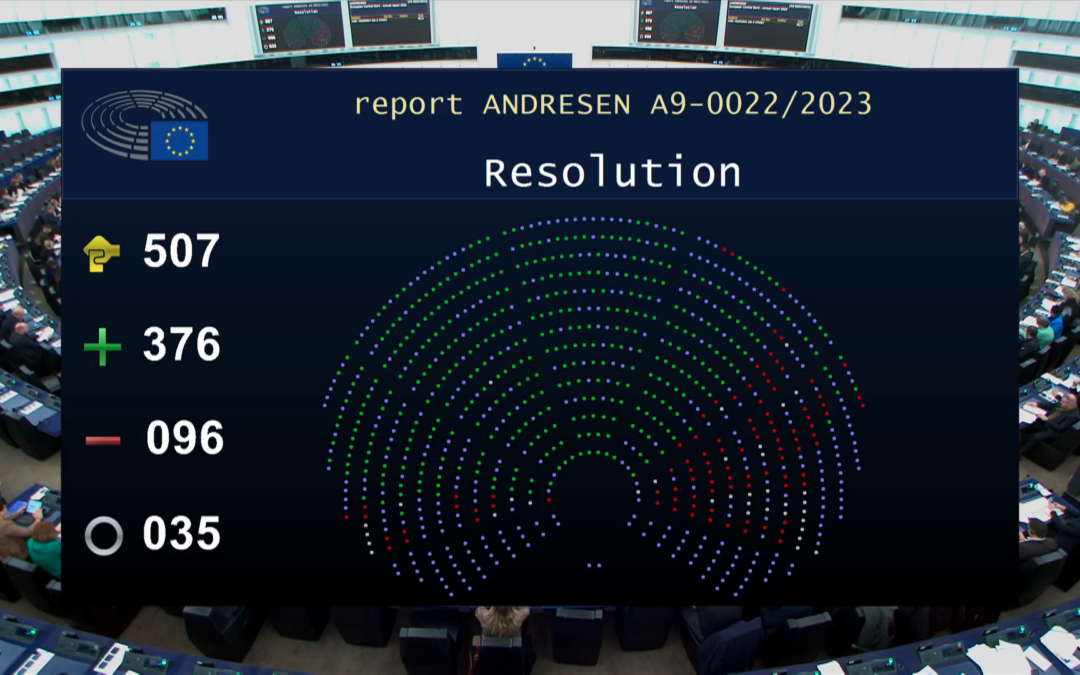

On the 16th of February, the European Parliament adopted a resolution offering a solution to the long-neglected secondary mandate of the European Central Bank (ECB) but fails to acknowledge the link between our dependence on fossil fuels and price stability.

by Positive Money Europe | Feb 9, 2023

In a vote this morning, the European Parliament’s committee on energy adopted an ambitious position on the review of the Energy Performance of Buildings directive, with stronger standards and obligations to renovate while ensuring financing will be available for people in the form of subsidies and bank loans.

by Positive Money Europe | Feb 2, 2023

The ECB increases rates by another 0.5 percentage points despite its’ forecasts being wrong. This decision is unprecedented and will have serious socioeconomic consequences.