The European Central Bank (ECB) points to wage developments as a cause of concern, arguing that it jeopardises their capacity to reach their inflation target of 2%. This is an unfounded fear, as current wage trends are a natural development against the backdrop of the recent energy shock. Being guided by this concern, the ECB is erring on the side of too tight for too long.

Recent wage increases would come as positive news to almost everyone. However, this is not the case within the camp of central bankers, who, with a few exceptions, tend to view rising wages with apprehension. In what follows, I will counter these concerns by emphasising three key points. First, wages need to grow above past trends to make up for lost ground. Second, there have been inconsistencies within the ECB’s narrative concerning wages and inflation throughout its tightening cycle. Lastly, current wage dynamics are not at odds with the ECB reaching its inflation target.

- Wages need to make up for lost ground

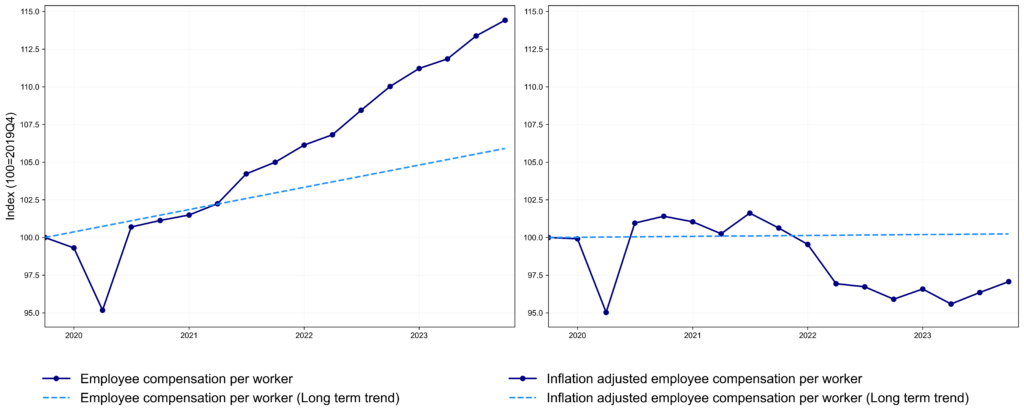

The ECB is concerned by employee compensation having risen above its long-term trend since late 2022, as we can see in Figure 1 (left-hand panel). However, employee compensation adjusted for inflation is slightly above 2020 levels, having fallen substantially below its long-term trend (right-hand panel). Hence, rising wages should be seen as a normal consequence of the energy shock, namely as a delayed outcome of the price shock.

Figure 1: Employee compensation per worker (euro area)

Source: Eurostat

The latest increase in wages is still insufficient to recover the loss of purchasing power experienced during the last few years. Wages will have to grow above trend over an extended period to cover that lost ground. The ECB, which resorts to the importance of households’ purchasing power when defending the relevance of its inflation target, should embrace that development.

- Past ECB narratives on wages are at odds with present ones

The ECB has adopted different stances throughout the monetary tightening cycle that started in summer 2022. Initially, it admitted that such a policy course couldn’t counteract the energy price shock. Nonetheless, it still deemed it necessary to avoid inflation expectations getting de-anchored, leading to a wage-price spiral. As wage earners were bearing the brunt of an energy shock not seen since the 70s, the ECB was already pointing at them as a cause for future concern.

President Lagarde explained that the negative terms of trade shock – the ratio of foreign to domestic prices – acted as a quasi-tax that made the euro area economically worse off. The ECB argued that it was not its role to decide how the shock was distributed throughout society. Instead, it underlined the importance of preventing anyone from passing on the shock by either increasing wages or profits, which would have further increased prices, leading to second-round effects. The ECB argued that during the disinflation phase, it has been workers who have led to these second-round effects by pushing for higher wages. According to the ECB, wage-driven effects make inflation more persistent, justifying keeping interest rates higher for longer.

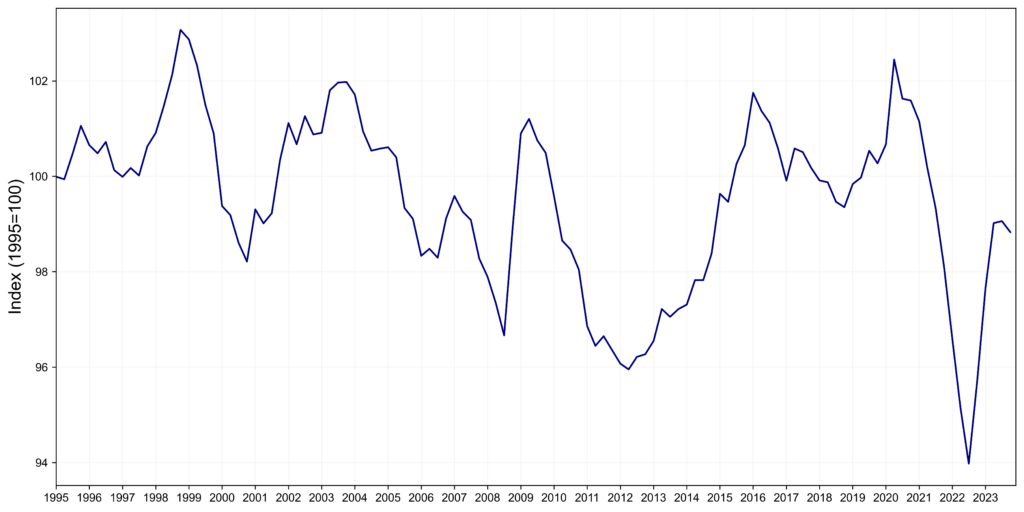

Terms of trade have markedly improved since late 2022, as illustrated in Figure 2. Deteriorating terms of trade entailed that society had to bear the shock, as higher prices of imported goods relative to exported ones lead to a loss of purchasing power for euro area residents. Reversely, an improvement in the terms of trade means that we are better off. If the ECB saw falling real wages as a normal development given worsening terms of trade, it must now stand ready to apply the same line of thought as the terms of trade move in the opposite direction. Failing to do so means that the ECB is contradicting itself.

Figure 2: Terms of trade (euro area)

Source: Eurostat

- Rising wages are not at odds with the ECB reaching their inflation target

The ECB has expressed worries that rising wages can undermine reaching the inflation target. ‘Wage pressures’ have been singled out as the crucial determinant for a move to cut interest rates. For instance, Klaas Knot, president of the De Nederlandsche Bank (DNB), argued that the ECB needed to observe lower wage growth before starting to cut rates.

This follows the ECB’s widely held belief that a growth rate of wages over 3% is not consistent with its 2% inflation target. What exactly does this imply? The rate of growth of domestic prices (measured by the GDP deflator), which encompasses prices of goods produced domestically, can be expressed as the sum of three components: wage growth, productivity growth and the growth of the labour share. If we keep growth of labour share constant, and assuming that productivity growth falls within the 1–2% range, wage growth with a 2% rise in prices would amount to 3%.

There are three critical aspects to this line of reasoning. Firstly, the ECB does not target domestic prices. The harmonised index of consumer prices (HICP), the ECB’s benchmark for measuring consumer price inflation, encompasses goods produced both domestically and abroad. The recent rise in prices was mainly due to a spike in foreign energy prices. As terms of trade improve (Figure 2), this can offset domestic price increases on the ECB’s price inflation benchmark, the HICP.

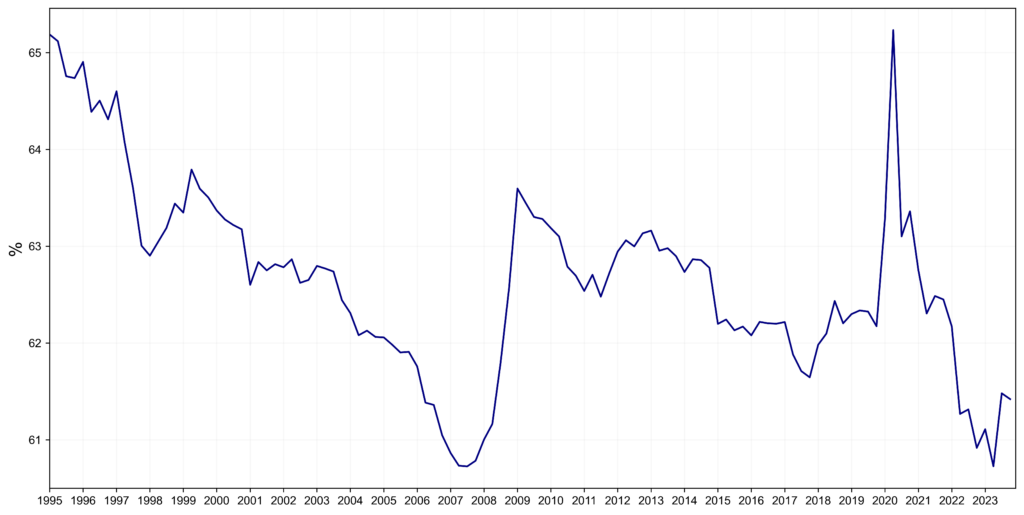

Secondly, even when we consider domestic prices, the impact of the increase in wages on domestic prices would depend on how productivity and the wage share develop. The wage share denotes the portion of GDP allocated to workers. The logic is straightforward: companies can absorb wage increases by reducing their profit margins, meaning that the wage share could increase, while keeping prices stable. However, as inflation increased, unit profits surged. This means that corporations have plenty of margin to absorb wage increases without passing it on to prices. As illustrated in Figure 3, the current wage share remains lower than pre-Covid-19 levels.

When the relationship between wages and inflation is discussed, the wage share tends to be ignored. Doing so means ignoring this distributional shift in favour of corporations and against workers.

Figure 3: Wage share (euro area)

Source: Eurostat

Finally, in terms of productivity, the euro area has not been performing great in recent years, while we are observing a steep rise in productivity in the US. According to some economic commentators, this can be linked to the strong labour market and wage increases. They posit that these conditions have incentivised firms to invest, innovate and create the proper environment for workers to acquire skills in the workplace.

In the proper setting, a strong labour market with wage growth can lead to higher productivity. As such, changes in wages should not be viewed as independent from economic conditions.

The ECB has been unjustly zooming in on wages throughout this inflation cycle. But it is imperative for wages to continue rising above past trends, considering the significant ground yet to be covered to restore the lost purchasing power. The decline in import prices and corporations’ capacity to absorb wage increases means that such upward movement is not contradictory to achieving the 2% inflation target.

In his recent speech, Piero Cipollone, the newly appointed Executive Board member of the ECB’s Governing Council, articulated several key issues outlined above. These included the imperative for wages to regain lost ground, the need for rebalancing between wages and profits, and the potential positive repercussions that increasing wages could entail for productivity. We hope that his voice will be heard within the ECB.