Several NGOs including Positive Money Europe are demanding that the central banks’ green finance forum steps up its work to make sure emergency measures taken by central banks against Covid-19 do not harm long-term climate action.

On 10 April 2020, Positive Money Europe, together with Les Amis de la Terre, Reclaim Finance, Sustainable Finance Lab, The Sunrise Project and the Veblen Institute for Economic Reforms, have published a letter calling on the Network for Greening the Financial System (NGFS) to push central banks to honour their environmental commitments during the financial crisis caused by Covid-19.

Emergency measures taken by central banks, such as the European Central Bank’s (ECB) €750 billion new quantitative easing (QE) programme, were essential to stabilising a financial system in freefall and limiting long-term economic damage in response to the crisis by supporting government’s emergency spending.

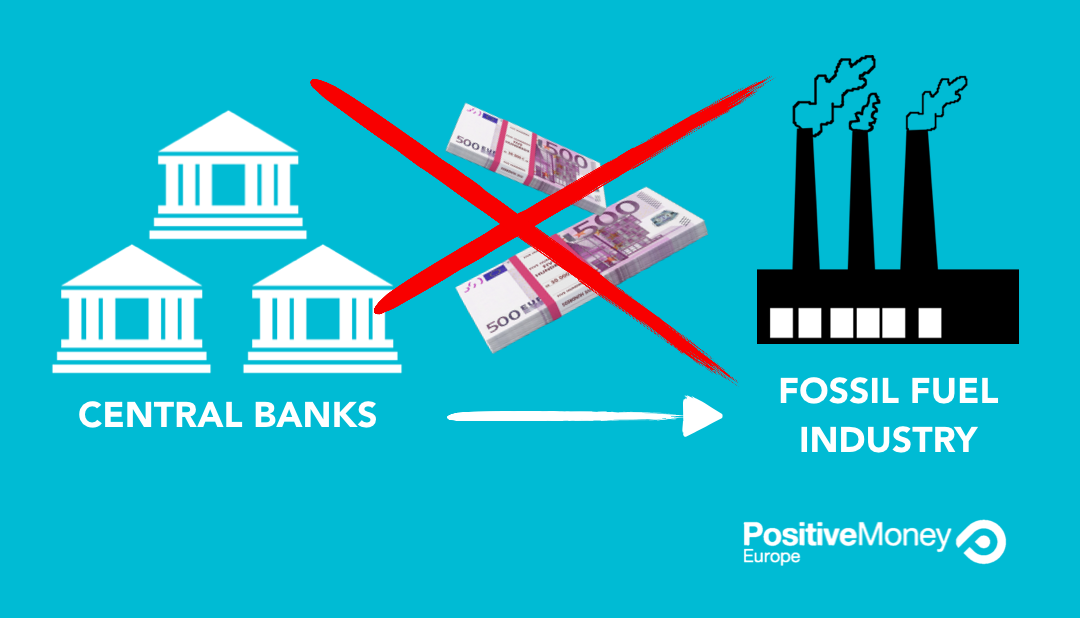

These emergency measures did however leave the door open for large, polluting multinationals to swoop in and take advantage of support provided by central banks. As Positive Money Europe showed in a report last year, more than 60 percent of companies benefiting from the ECB’s QE programme are the same companies who are most responsible for climate change.

As long as central banks follow the mistaken logic of ‘market neutrality’, they are injecting money into companies without considering the negative climate impact those companies are having. In this context, the more central banks support the economy, the more polluters can benefit from them.

The NGFS network has been a promising space where progressive ideas on sustainable finance have flourished. The ECB and 63 other central banks are members of the NGFS and Christine Lagarde committed to deepen the ECB’s engagement in its work.

We are calling on the NGFS to step forward with proposals to guarantee that central banks’ emergency measures are brought back in line with governments’ long-term climate objectives.

For example, the NGFS should specifically demand that assets owned by highly polluting multinationals – such as those who burn coal or unconventional oil and gas – are excluded from the collateral frameworks of all central banks.

As NGFS Chairman Frank Elderson remarked in the network’s last progress report, even in a financial crisis, central banks “should not lose sight of the fact that climate change remains an urgent and vital issue”.

In light of Elderson’ statement, we are hopeful the NGFS will commit to help in this endeavour, but the NGFS’ recommendations so far do not really touch upon the core of the monetary policy dimensions of central banks’ work. With this letter we want to encourage them to go further, and to remind them of our readiness to support and engage in the NGFS’ work.

Failure to address the climate crisis now, will only lead to further crises down the line. But swift and concrete action could empower the financial system to be a driver of genuine environmental protection in the years ahead.