The European Central Bank (ECB) and European Banking Authority (EBA) are failing to walk the talk on fighting climate breakdown and are lagging behind China and Brazil in their actions in response to climate change, a new study by Positive Money UK reveals.

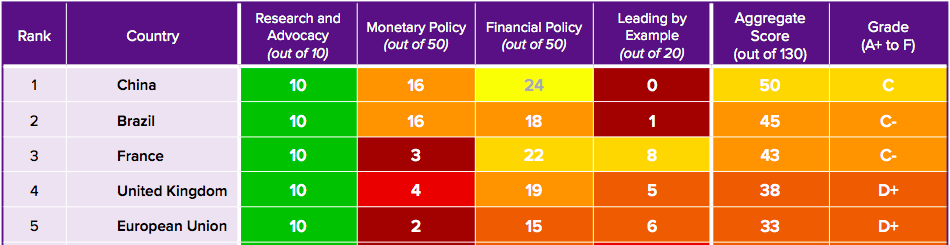

The Green Central Banking Scorecard, which ranks and grades every G20 central bank on the progress they have made in becoming environmentally sustainable, awarded the European Union (EU) only 33/130. This placed the EU fifth among G20 countries, behind China, Brazil, France and the United Kingdom and getting a D+ grade.

The scorecard judged the ECB and other central banks on four categories – research and advocacy, monetary policy, financial policy and whether they are leading by example.

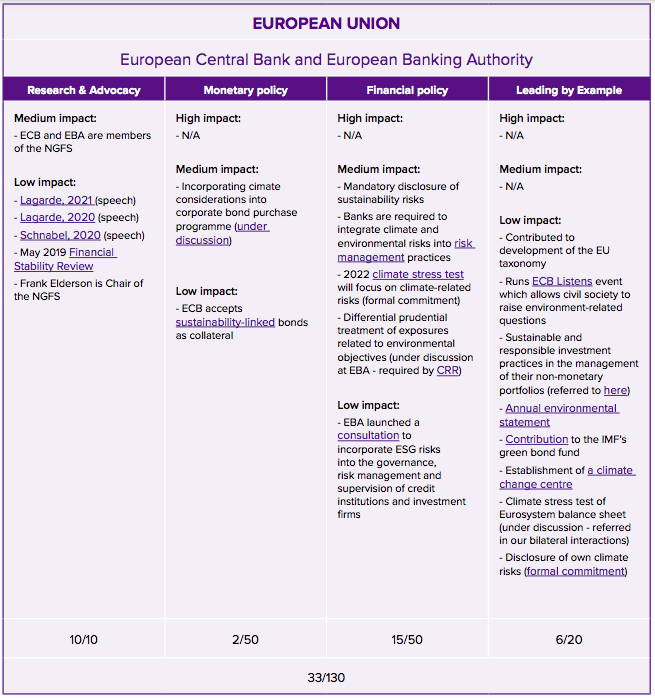

The ECB scored 10/10 on research and advocacy through being a member of the Network for Greening the Financial System, an international network of central banks and financial supervisors which researches how central banks worldwide can help fight climate change. The bank gained additional points through President Christine Lagarde and Executive Board member Isabel Schnabel publicly supporting green policies.

Scoring just 2/50, the ECB’s monetary policy is far less climate-friendly. The bank accepts sustainability-linked bonds as collateral and is considering incorporating climate considerations into its corporate bond purchase programme, but these initiatives have led to little change at present.

The EU’s financial policy is slightly better, scoring 15/50. Measures introduced include mandatory sustainability-related disclosure in the financial services sector and requirements for banks to integrate climate and environmental risks into risk management practices. However, these measures are medium impact at best, keeping the score low.

The ECB is also failing to set a global example in implementing climate policies. The bank has sought to actively engage citizens in its policy making through the “ECB Listens” initiative, released an annual environmental statement and established a climate change centre. However, these are small steps which have had no tangible long-term impact as-of-yet, scoring 6/20.

Globally, the report reveals a glaring absence of high-impact policies that meaningfully reduce financial support for fossil fuels across the G20. When central banks have integrated climate considerations into their policies, they have focused on financial disclosures, stress tests, and encouraging lending towards green assets, rather than winding down financial support for fossil-fuel-intensive and ecologically harmful activities.

Both Positive Money Europe and Positive Money UK demand that policymakers urgently remedy this situation by taking action to exclude unsustainable activities from the assets they purchase and accept as collateral for lending, and for financial regulation to penalise high-carbon lending, with higher capital requirements to more accurately reflect the risk of fossil fuel investments.