The new inflation target of the ECB offers minimalistic improvements and lacks credibility. Although the ECB wants to get rid of its deflationary bias, it shies away from considering more forceful and radical instruments that could achieve that, giving itself instead more convenient justifications for missing the target in the future. The ECB will have to consider more paradigmatic changes to its monetary policy when it next reviews its strategy in 2025.

On July 8th, the ECB revealed its new monetary policy strategy framework, which includes a change to its inflation target, moving away from the old target formulation of “below but close to 2%” to a simple 2% target. The change is subtle, but important: instead of aiming to have an inflation rate around 1.9% (or below), the ECB will now allow inflation to move flexibly around (including above) the 2% target.

Removing the deflationary bias

The main motivation behind this change is to remove the asymmetry entailed in the old formulation, which implied a preference for lower rather than higher inflation – the so-called “deflationary bias”.

As ECB Executive Board Member Isabel Schnabel acknowledges, such perception could give rise to “meaningfully lower inflation and growth outcomes” as well as “further entrench expectations of low inflation”. Hence, by clarifying its target to be symmetric at 2%, the ECB hopes to raise inflation expectations to anchor them at 2% in the long-term.

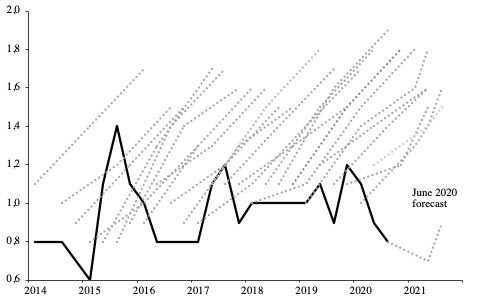

Indeed, over the last decade, the ECB has consistently failed at reaching its inflation target, each time missing its overly optimistic forecasts.

While the clarification is welcome, it doesn’t bring anything really new. Already in 2016, the former ECB President Mario Draghi, and in 2019 the Governing Council, had conceptualised the old target to be symmetric. This is one of the reasons why we doubt many observers and market participants will adjust their inflation estimates upwards.

In principle, we welcome the ECB’s intention to let inflation go above 2% (for once, after 10 years of undershooting!). Moreover, the recovery from the Covid-19 pandemic would greatly benefit from temporary inflation overshooting: “running the economy hot” in the recovery phase is the best way to ensure all workers and capital get (re)employed and thus help the economy reach its pre-crisis growth pace.

But does this new inflation target inspire confidence that the ECB will finally reach its target on a durable basis? Unfortunately, we doubt the ECB’s new strategy is credible enough to do that.

A more notable change would have been a generally higher inflation target, or a target formulation of 2% on average – as the US Federal Reserve decided last September. Both would have raised expected inflation, the latter because the ECB would have signalled that it is ready to make-up for past below-target performance.

A weaker change than the US Federal Reserve

In its strategy, the ECB only states that it will tolerate inflation target overshoots, whereas the Federal Reserve committed to aiming at overshoots.

This is not mere semantics.

Jerome Powell, Chair of the Federal Reserve, made clear that aiming at inflation moderately above 2% is a more deliberate and less opportune approach than simply tolerating it. The conceptual difference also seems visible in the current monetary policy stance. While the Fed actively pushes for more inflation, the ECB will passively wait for inflation to come.

Moreover, when defining its monetary policy reaction, the ECB sweeps past inflation misses under the carpet and only considers actual and expected phenomena, whereas the Fed, in addition, also considers past data. The Fed’s strategy, therefore, enables it to be more forceful and to let inflation rebound more quickly, which is why it also brings it more clearly on a path for overshooting than the ECB.

No new insights on instruments

All monetary policy tools that centre on communication work through influencing what households and firms expect inflation to be. However, inflation expectations are hard to measure and are not easily proven to strongly influence actual prices. Especially in low-inflation environments households and firms hardly care about expected inflation, being even harder to influence than usual.

What seems more effective than influencing inflation expectations is to directly adopt policies that boost aggregate demand. In this regard, asset purchases have proved to be limited and insufficient as witnessed by consistent undershooting of the target. Endless QE, for example, is rather causing unintended side effects, such as the rise in asset prices further exacerbating wealth inequality.

Unfortunately, despite Christine Lagarde’s promise to “leave no stone unturned” the ECB did not seriously consider new instruments such as helicopter money. Coming in the form of a direct transfer to households by the central bank, it would be simpler and more effective in boosting inflation compared to asset purchases programmes. This is partly because it gets money to households with a high propensity to consume. Helicopter money is also less likely to increase wealth inequality than asset purchases are.

An unclear time-horizon

There is one further aspect that indicates the ECB has taken an overly cautious approach to (raising) inflation. In its old strategy, the ECB argued that its target had to be reached “over the medium-term” to avoid output and employment volatility that would result from not waiting out the effects of monetary policy. Hence, the medium-term horizon was defined as relating to the time lag that it takes for monetary policy to show its effects.

In its new strategy, the ECB justifies the medium-term horizon differently, saying that it allows the Governing Council to take account of macroeconomic variables such as employment, financial stability and other matters pertaining to the proportionality of a policy. In the ensuing press conference, Lagarde clarified that, hence, the medium-term orientation extends beyond the projected time-lag of monetary policy. This makes the time-horizon in which the target is to be reached even more unclear.

The unclarity of the target translates into more flexibility for the ECB. Such flexibility could be put to good use, for example by better adjusting its policies based on a myriad of factors, including real-time, observed data. But as former ECB Board Member Lorenzo Bini Smaghi fears, this will also give ECB policy-makers even more space to justify deviations from the target. Once again, the result could be that the ECB will accept low inflation for longer than before.

Looking towards the next review in 2025

Only time will tell whether our concerns are right. But based on what we know at this stage, the new ECB strategy offers only some minimalistic improvements, and we cannot be confident that the ECB will finally achieve its inflation target.

Going forward, the ECB will need to do more than adopting minimalist changes and resorting to more flexibility. Indeed, the current inflation targeting paradigm stemming from the 1970s and consisting of “price stability as the primary goal of the central bank, central bank independence as the institutional arrangement and the short-term interest rate as the operational target” (see Braun & Downey, 2020) – is facing increasing challenges.

Fortunately, the ECB decided to conduct the next strategy review already in 2025, so we won’t need to wait another 17 years before this issue and potential alternatives such as nominal income targeting can be revisited. Positive Money Europe will work to ensure the next ECB review does not miss the opportunity to consider more paradigmatic changes to its framework.

Stanislas Jourdan and Uuree Batsaikhan also contributed to this article.