The European Central Bank decided to raise interest rates, in an attempt to show its determination to fight inflation. However this decision is based on shaky justifications, which are likely to cause more harm than do any good for citizens’ purchasing power.

Today, the ECB hiked its key interest rates by 75 basis points. When the ECB first hiked rates after 11 years, we already explained why we think that blunt interest rate increases are not the right tool to address current price increases. But with today’s decision, the ECB double-downs on an ill-suited strategy.

The broader justification for the ECB’s aggressiveness was given by Isabel Schnabel at a remarkable speech at a conference in Jackson Hole, Georgia, USA. In this speech, she pronounced that we’re at a turning point, moving from the “Great Moderation” period to a new era of “Great Volatility.” To face this new reality, Schnabel argues the ECB we should choose a path of “determination”, by acting more aggressively than before. After today’s decision, it appears the other 24 ECB Governing Council members agreed with her.

In this article, we critically assess Schnabel’s justifications for this approach, and show that If the ECB really intends to continue reacting to supply-driven, volatile price changes with massive blunt interest rate hikes, we are up for a bleak future.

The threat to “central bank credibility” is largely an illusion

The first reason for Schnabel is a higher threat to central bank credibility. She says that “the surge in inflation has started to lower trust in our institutions”, for which she cites a Eurobarometer survey. According to her, this might follow from people thinking that the ECB reacted too slowly to current price increases or because they think that the ECB’s new strategy of 2021 focused too much on deflation. Both “may have created perceptions of a higher tolerance for inflation” that must be broken by aggressive action.

But these claims are very far-fetched. The survey that Schnabel cites does not provide evidence that price increases are behind the lowering of trust. The ECB is taking itself far too seriously if it thinks that most people are paying attention to its policies and revising their expectations about future price developments accordingly. In a representative survey, 55% of respondents said they are not interested in the ECB and 27% are not interested at all. The idea that ordinary people clearly attribute the current price increases to bad ECB decisions in the past or to the new ECB strategy is dubious and lacks concrete evidence.

Also, to make a case for tightening, it is not enough to find that price increases (or uncertainty about how the ECB reacts to them) have led to a lowering of trust in the ECB. Why should aggressive interest rate hikes be able to regain that trust? And why should one be confident that it is precisely the credibility of the ECB, an institution few people know, that is crucial for price growth to be low? The usual answer to the second question is that central bank credibility is key for stable inflation expectations. But to us, this is a concept riddled with problems (1) which is severely lacking in application, as we discuss below.

Pointing to “inflation expectations” is a lacklustre argument

A second key reason for a more-than-usual aggressiveness is directly flowing from inflation expectations. Schnabel observes that the increases in consumers’ medium-term inflation expectations have increased from 2% to 3%. She then argues that the “risks of a de-anchoring of inflation expectations are rising”. Later, she implies that inflation expectations are not well-anchored. The suggestive conclusion: aggressive tightening is in order.

However, higher inflation expectations alone should not justify policy tightening. For one, it is not clear that interest rate increases reduce people’s inflation expectations. And crucially, we lack evidence that inflation expectations automatically lead to higher inflation.

For inflation expectations to matter, consumers need to change their behaviour in anticipation of future price increases. This means that consumers need to consume more (e.g., durable goods) or succeed in demanding higher wages *because* they think that goods and services will be more expensive in the future. If people do not change their behaviours based on their personal inflation predictions, then inflation expectations are quite irrelevant in the first place for the formulation of today’s monetary policy.

For wages and consumption to be a driving factor for inflation, induced by higher inflation expectations, they need to rise by a lot. Wages need to increase by significantly more than the sum of price growth and productivity growth, while profits and non-labour costs remain unchanged. (2) Compensating for past inflation and productivity gains is not inflationary.

But currently, we don’t see this happening. The experimental ECB wage tracker indicated that the wage increases agreed in the first quarter of 2022 implied annual wage growth of around 3%. In the second quarter, negotiated wage growth even decreased to 2.4%. This not only marks a big real income loss for employees, as prices are rising by much more, but is also entirely consistent with a steady-state inflation of 2%. On the consumption side, there are also no signs of consumers bringing forward purchases due to fearing prices to rise further.

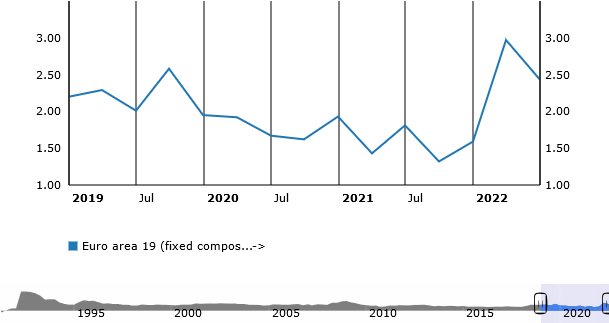

Index for negotiated wages in the Eurozone

The y-axis shows the % changes, year-on-year, of the index. The x-axis shows the time in quarters. Source: ECB

Overall, the likelihood of much higher consumption and above-inflation wages to happen in the future remains low. The ECB’s tracker predicts a wage growth of 2.5% next year which indicates that we are far away from a price-wage spiral that central bankers fear so much. It might well be the case that workers will claim higher wages after firms enjoyed massive profits but a rebalancing between profits and wages does not represent the start of an inflationary spiral. With the structural condition of low unionisation still in place, there is little reason to assume that workers will succeed in extracting ever increasing wages from their bosses. On the consumption side, households are expecting to make few major purchases, maybe reflecting fears about an economic downturn for which signs are increasing.

All in all, we don’t see the movement in wages and consumption that we would need to see for high price increases to become persistent. Even if the likelihood of higher wages in the future increases, the likelihood of a price-wage spiral remains very low. And what should be very clear: Pointing to movements in inflation expectations (irrespective if they are coming from more financially literate consumers) is insufficient to make a case for tightening.

The ECB is overconfident in the effectiveness of interest rates

Schnabel’s other core argument is that, faced with strong price increases in the present, it is better to act earlier than later. This is because the potential cost of acting late is much higher than the cost of acting today. Certain economic developments, e.g., the economy having become less interest-rate sensitive, have made this trade-off even starker.

This argument hinges on the assumption that current price increases become persistent which is something that the ECB is uncertain about (and that we deem unlikely). But in the face of this uncertainty, Schnabel argues that it’s wiser to react strongly. Why? The Söderström (2002) paper cited by her says that “it reduces uncertainty about the future path of the economy”. But does it, and if yes, what kind of future path?

In our view, the only uncertainty that gets reduced with aggressive interest rate hikes is that we’re heading into a recession. We are not confident that rate hikes will bring down price growth. Even if one believes that uncertainty requires action now, it is only wiser to react particularly aggressively if one believes that one’s tool is effective. That is what we dispute. Given that blunt interest rate hikes unfold much of their effect through the labour market, reducing demand, we do not think that rate hikes are effective in dealing with current supply-driven price increases.

Schnabel doesn’t give reasons for why we should believe that the ECB hiking rates will reduce price surges. To her, in the case of uncertainty about the persistence of inflation, it would be “largely irrelevant whether inflation is driven by supply or demand”. Her uncertainty about the persistence of price increases seems to trump her uncertainty in the effectiveness of interest rate hikes to bring price increases down.

Curiously, the Söderström (2002) paper that Schnabel cites mentions both types of uncertainty. And strikingly, it says that “uncertainty about the impact effect of policy still leads to less aggressive policy”, a nuance that is missing in Schnabel’s speech.

Aggressive hikes are woefully unjustified

Overall, there is weak evidence for current price increases to manifest into ongoing high inflation. Even more so, there is significant doubt that interest rate hikes are effective in the current situation. The ECB’s own analysis as well as the symmetry and medium-term orientation of its target should be enough to show that aggressive hikes are not in order.

But despite the insufficient evidence, Schnabel concludes that “determined action is needed to break these perceptions [of inflation-tolerance]”. In her own words, this means reacting “more forcefully to the current bout of inflation, even at the risk of lower growth and higher unemployment”. Supposedly, loads of people getting fired is the “sacrifice” we should be ready to accept for lower inflation. And we know that people who earn little are those most likely to get fired first. (3) As low-income households are currently suffering the most from price increases (4), aggressive rate hikes would double-down on their pain.

The gap between the seriousness of the suggested policy implications and the empirical evidence mobilised to justify it is unreasonsable.

A new era requires a new model

Paradoxically, although we disagree with Schnabel’s conclusion, we largely share her diagnosis. With global labour supply stagnating and energy supply being insecure, we don’t anymore have a good buffer that can shoulder demand spikes, preventing price increases. At the same time, climate change and increased geopolitical instability imply that economic production will get more and more disrupted, further limiting the ability of firms to smoothly react to changes in demand. The result: supply and demand mismatches, breeding higher prices, happening more often, more randomly, and lasting longer. The type of price increase we will likely see more in the future.

Frustratingly, we draw radically different conclusions from this diagnosis.

In our view, the new era of “Great Volatility” that Schnabel rightly describes also demands a new model of monetary policy. To account for the specificity of supply-driven price increases, this new model includes differentiated interest rates and targeted asset purchases to respond to sector-specific developments as well as support for fiscal measures that aim at stabilising essential prices. (5) It also includes close cooperation with fiscal authorities which is necessary in times of overlapping emergencies. (6)

But to instead double down on the faltering intellectual and policy framework of the 1980/90s is highly disappointing. We hope that this choice is not repeated by others and that central bankers will come to see the narrow-mindedness of what they propose.

———————

1) See Rudd (2022), Mui (2021), and Politano (2022) for good overviews of the messiness and inconsistencies related to the usage of “inflation expectations”.

2) For an insightful note on the role of wage growth in relation to price and productivity growth, see Bivens (2022).

3) This has been established in the literature we surveyed here.

4) This is because lower-income households spent a higher share of their income on energy, hence the high energy prices particularly hurt them. It was formally analysed, for example, by Claeys & Guetta-Jeanrenaud (2022).

5) See Isabella Weber’s fantastic work on this, and her interviews in the Guardian and Agenda Publica.

6) See Daniela Gabor’s op-ed on this in the Financial Times.