On Thursday, the European Central Bank (ECB) will add 25 basis points to the largest rate hike in the European Monetary Union’s lifetime. We argue that when observing leading indicators, it looks like the timing of Thursday’s hike will be inconsistent. The ECB will hike once again while an energy-driven disinflation process is taking place and the impact of its previous rate increases is being transmitted through the rest of the economy by way of depressed credit demand. The ECB should wait and see what the consequences of these processes are in driving prices down.

What do pipeline pressures tell us?

One important leading indicator is producer price indices and the prices of imported goods. Contrary to the harmonised index of consumer prices, which tracks the prices paid by consumers, producer price indices reflect the prices that businesses pay. Hence, movements in consumer prices are usually preceded by more volatile movements in producer prices.

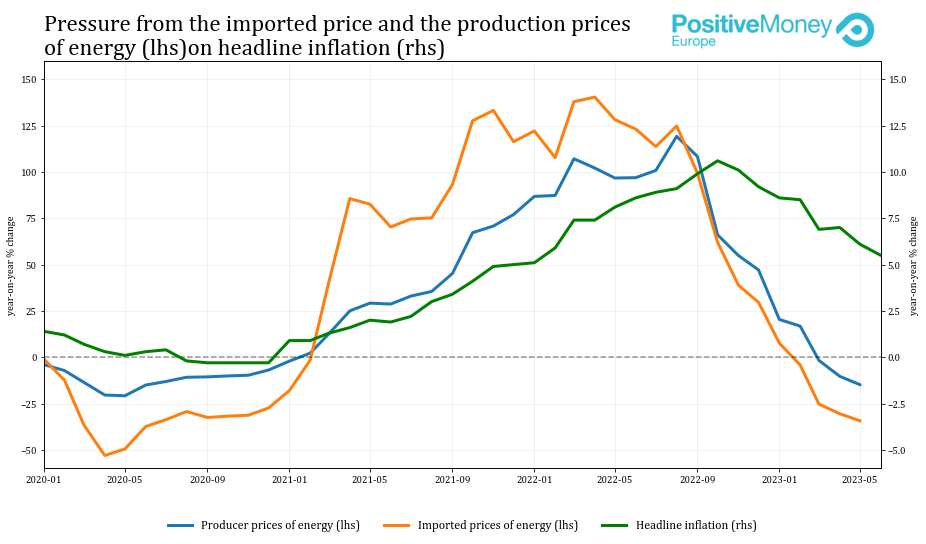

The price of energy played a determinant role in the rise of inflation experienced in 2022. As we can observe in the graph below, inflation in the euro area was preceded by a boom in imported energy prices, which reached a year-on-year percentage increase of 140% in April 2022. This was followed by a rise in producer prices for energy, reaching a peak of 120% in August 2022. Naturally, such an enormous increase in the price of energy led to an increase in headline inflation.

Once the price of energy started free-falling from late 2022 onwards, headline inflation followed. In 2023, the growth rate of both the imported price and the production price of energy entered negative territory. Therefore, we should expect this dynamic to keep having an impact on general inflation. Basically, we are experiencing the obverse process of what happened in the upside cycle of inflation. Now, falling energy prices are leading, with a lag, to a general fall in consumer prices, which have been falling since October 2022.

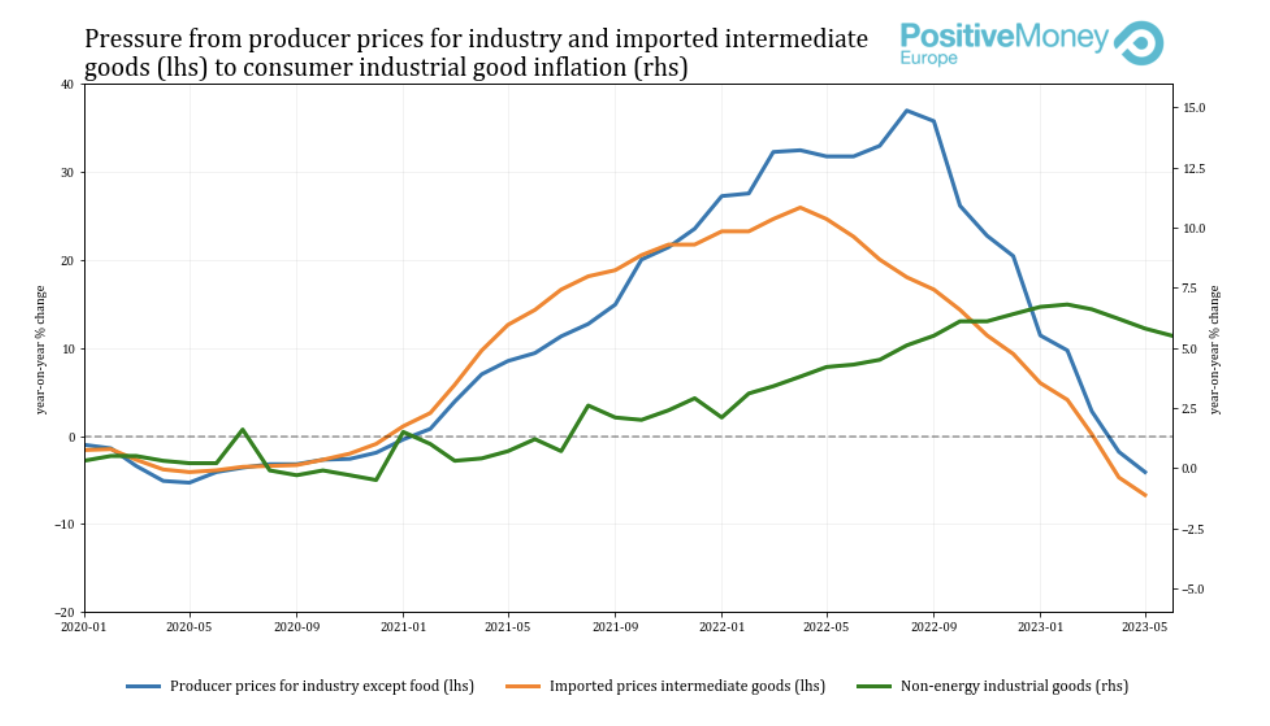

Another more granular example that can be used to assess the pipeline pressures on consumer prices is to see how the imported prices of intermediate goods and the producer price for industry are evolving, in comparison to the consumer prices of industrial goods. As we can see in the graph below, the price of industrial goods was preceded, with a lag, by the increase in pipeline pressures. Now, the rate of growth of both leading indicators is in negative territory. This indicates that we will continue to observe a fall in the consumer prices of industrial goods.

These pipeline pressures will also end up affecting services, which has proven to be the most sticky element of consumer inflation. Rising prices in services have been driven especially by energy-intensive items, for example, travel-related items. This latter component has contributed 0.75 percentage points to services inflation between January 2022 and March 2023. It would be misguided to attribute this to labour costs, instead of higher energy prices and the post-Covid reopening. Hence, while they are being stubbornly sticky, we should expect service prices to fall as pipeline pressures keep fading away.

The force of monetary policy transmission

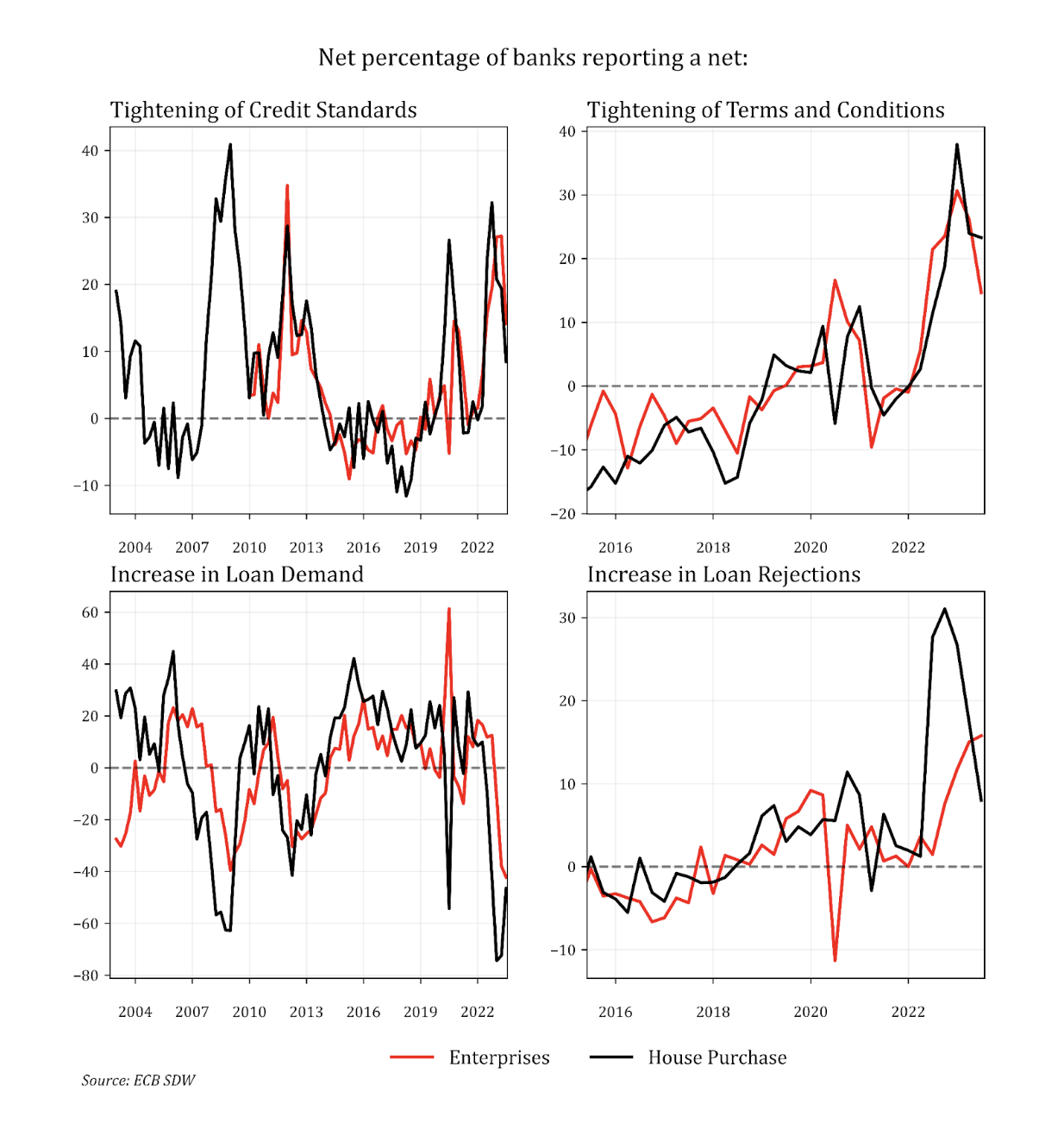

Another important leading indicator is the results of the Bank Lending Survey, which collects information about credit supply and demand conditions. In this case, the survey serves as a leading indicator of the strength of the transmission of monetary policy. One of the main mechanisms by which higher interest rates impact the economy is through bank lending. As we explained in a previous blog, it takes time for monetary policy to impact inflation, as it first needs to impact bank lending, which will then affect demand, eventually impacting inflation.

The latest Bank Lending Survey results show that banks kept tightening their credit standards (top left quadrant) and terms and conditions (top right quadrant) in the second quarter of 2023. More importantly, loan demands by enterprises have experienced their strongest fall since the beginning of the survey (bottom left quadrant).

Recapitulating, we’ve experienced a huge energy shock, which, combined with supply bottlenecks, has led to a broad increase in inflation. At the end of 2022, this process reversed: with energy prices falling, consumer prices followed, and these have been falling since October 2022. While this process is taking place, the ECB keeps increasing its interest rates, which is having significant effects on credit provision.

The ECB is risking being particularly out of tempo in its response. When the latest rate hikes eventually impact the economy, we may be in a completely different situation than the one we are in at this moment.

The ECB should observe how these macroeconomic dynamics play out, so as to understand the disinflationary force of the current situation. With macroeconomic indicators looking bleak, loan demand at record lows and energy prices still falling, it is difficult to find a clear justification for Thursday’s rate hike.

The bond market (with inverted yield curves) has been telling us since October 2022 that a disinflation process is underway. Economists like Jeffery Snider have long argued that inflation was not caused by increased spending but simply by supply chain problems caused by the wrong pandemic policies.

We shouldn’t forget that the Financial Market was next to the implosion (Credit Crunch) in 2019 when the Repo Market was in real trouble. The Central banks needed an excuse (Pandemic) to pump trillion$ and € of new debt to postpone the problems (Printing new debt cannot eliminate the problem which, in reality, is the corruption of politics and the “Revolving Door” with multinationals.)

On the other hand, rates close to zero have not boosted the economy. Consumption has rebounded after the “pandemic” only thanks to subsidies and the indiscriminate increase in public debt!

Low-interest rates have simply encouraged speculation. Companies were borrowing money at near-negative rates to buy back stocks and drive them up in value! Unscrupulous entrepreneurs had access to interest-free lines of credit and bought land or businesses from other struggling entrepreneurs!

The low-interest rate penalized those who intelligently and with much sacrifice saved money.

The history of Japan teaches us that low-interest rates do not help revive the economy. The Japanese economy stays afloat simply because the Japanese have given their lives to work.

In a healthy economy ( referring to the current economic system) interest rates should always be above the inflation rate of at least 200 bps to reward those who save and remunerate those who lend their money as well as curb speculation at zero risk.

The Bond market, since October 2022, has been challenging the Central Banks which are unable to do anything. Central Banks, at best, can manipulate very short-term rates but are powerless on long-term rates. The financial market decides. Central Banks are 98% Talk and 2% Action (Ben Bernake) Central Banks that create Currency out of Thin Air are a Ponzi Scheme because the Governments will never be able to pay their debt and the Debt and they need more debt to pay the older debt plus the interest and the debt will continue to grow till…..